Disclaimer: This article is for informational purposes only and does not constitute financial or tax advice. For guidance specific to your situation, consult a licensed tax professional or accountant in Toronto.

Running a business in Toronto comes with endless responsibilities, managing operations, growing revenue, keeping clients happy, and making sure the financial side doesn’t slip through the cracks. That last part is where many entrepreneurs find themselves facing a big decision: should they handle accounting and taxes on their own, or should they turn to Toronto tax and accounting experts for guidance?

It isn’t a simple choice. On one hand, doing things yourself can seem like a cost-saving move. On the other hand, professional expertise can help uncover hidden value, prevent costly mistakes, and free up your time for higher-impact work. Let’s break down the key considerations so you can decide which approach makes sense for your business.

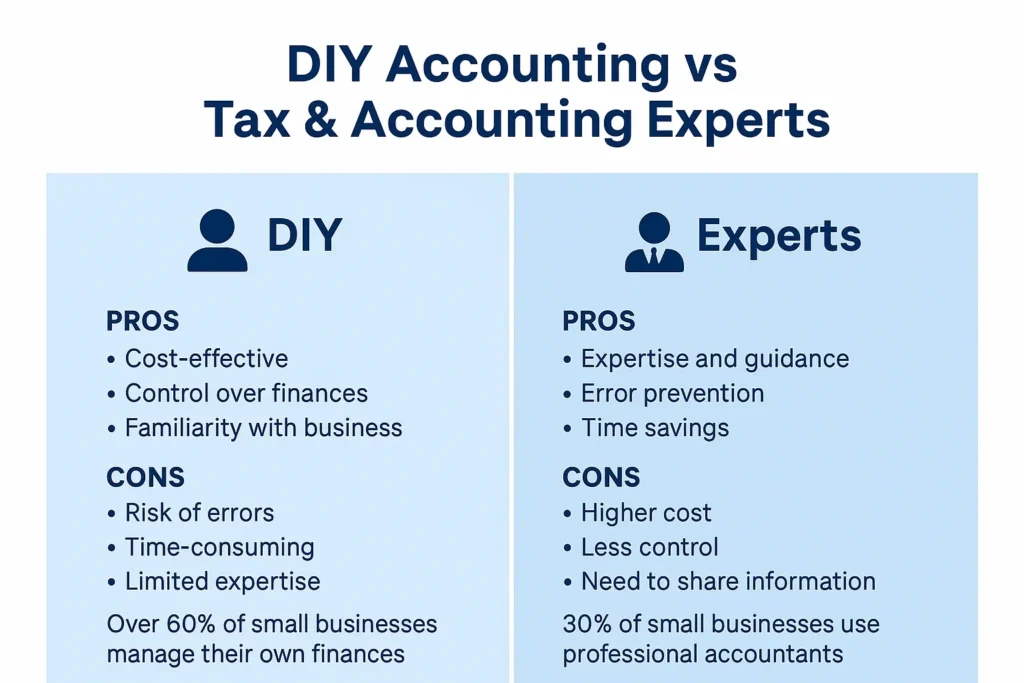

The Appeal of DIY Accounting

At first glance, handling bookkeeping and tax filing on your own looks straightforward. Cloud-based software tools like QuickBooks, FreshBooks, or Wave are marketed as user-friendly, and they’re often affordable. For solopreneurs or tiny businesses with limited transactions, these platforms can be a good fit.

The real draw is control. Many owners feel they know their finances better than anyone else. By doing it themselves, they believe they’re saving money on professional fees and staying closely connected to their business’s numbers.

But here’s the thing: control doesn’t always equal accuracy, and it rarely equals efficiency.

The Risks of Handling Finances Alone

Numbers don’t forgive mistakes. A small error in data entry or a missed tax deduction can snowball into penalties, cash-flow issues, or even compliance problems with the CRA. Beyond the immediate risks, DIY accounting can consume a substantial amount of time.

When you’re spending evenings reconciling accounts or trying to interpret new tax regulations, that’s time not spent on sales, strategy, or customer relationships. In other words, the opportunity cost of DIY is often higher than the out-of-pocket expense of hiring an expert.

The Value Professionals Bring to the Table

Taxation in Canada isn’t static. The CRA updates its rules frequently, and what applied last year may not be applicable this year. Professionals keep up with these changes, so you don’t have to. Their expertise isn’t just about compliance, it’s about optimization.

For example, an accountant can identify industry-specific deductions, structure your business in a tax-efficient way, and advise on whether to incorporate. They can help you navigate GST/HST obligations, payroll complexities, and cross-border tax issues if you work internationally.

The real value isn’t in data entry; it’s in strategy and foresight.

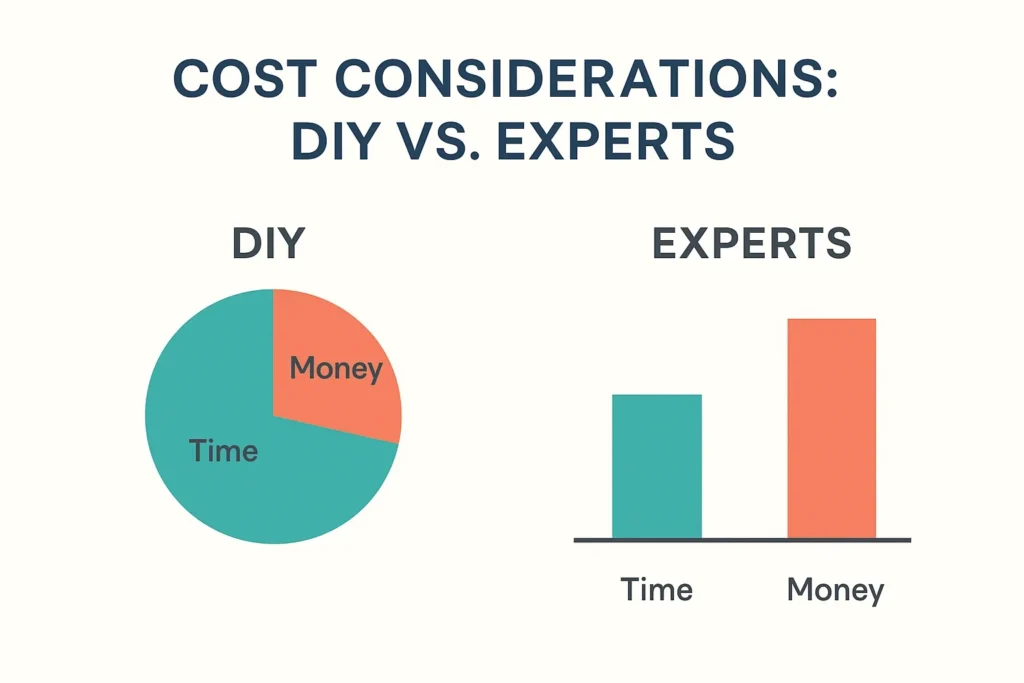

Cost Considerations: DIY vs. Experts

Money is often the deciding factor. Hiring an accountant or bookkeeper comes with fees, while DIY seems “free” if you ignore the value of your time. But think about this: if you spend 10 hours a month managing your books, and your time is worth $100 an hour, that’s $12,000 annually.

Now compare that to the cost of outsourcing to a professional who can probably do the work more accurately and in less time. When framed this way, the expense of professional help often becomes easier to justify.

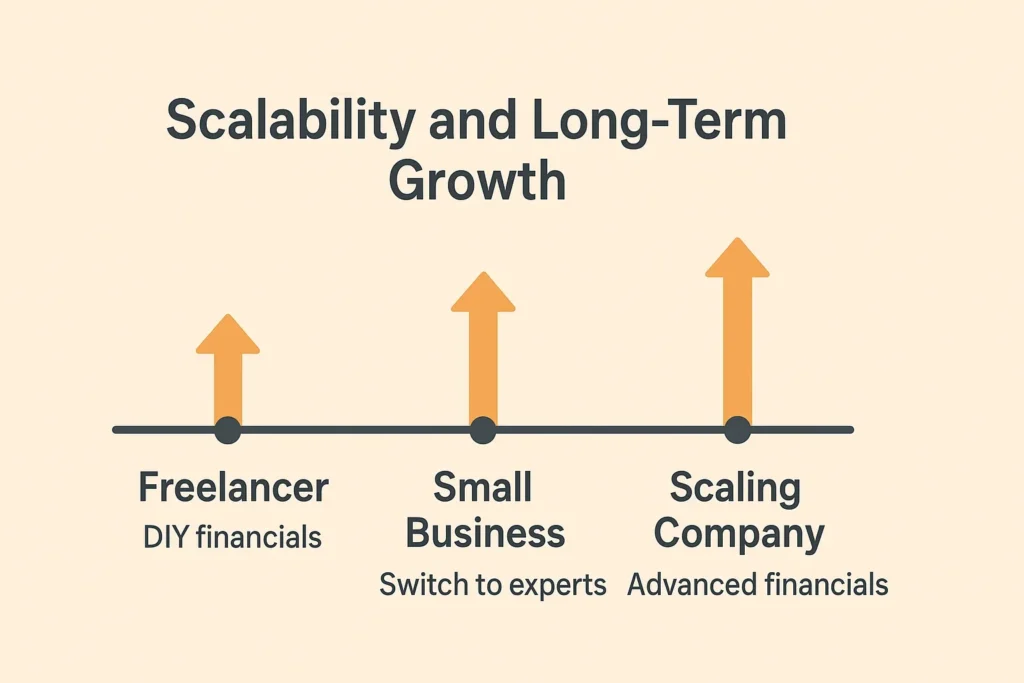

Scalability and Long-Term Growth

What works for a sole proprietorship in its first year won’t necessarily work for a business with employees, assets, or multiple revenue streams. DIY accounting systems tend to buckle under growth.

Professionals, on the other hand, scale with you. They can introduce advanced reporting, cash flow forecasting, and budgeting practices that provide clarity as you expand. They can also prepare you for audits, investor due diligence, or financing applications, all moments where sloppy records can hurt your chances.

Peace of Mind and Reduced Stress

Running a business is stressful enough. Worrying about whether you filed your taxes correctly or wondering if you’re missing deductions only adds to the pressure. Outsourcing to an expert offers peace of mind.

You can rest easy knowing deadlines are met, compliance is handled, and you’re taking advantage of available tax efficiencies. That mental space alone is often worth the investment.

Situations Where DIY Still Works

Not every business needs full-scale professional support right away. If you’re freelancing on the side, have very few expenses, and your tax situation is straightforward, DIY can be a viable option at least temporarily.

The key is to be honest about your skill level and your willingness to stay on top of financial details. If your business grows, you should be ready to transition to expert help sooner rather than later.

Striking a Balance

It doesn’t have to be an all-or-nothing decision. Some businesses adopt a hybrid approach: managing basic bookkeeping internally while consulting experts at tax time or for strategic advice. This model can provide a balance between cost savings and professional insight.

The right mix depends on your goals, resources, and appetite for risk.

Final Thoughts: Choosing the Path Forward

Whether you take the DIY route or work with professionals, the most important thing is to have a system that’s accurate, timely, and aligned with your growth. DIY might work for a while, but it can limit scalability and expose you to unnecessary risk.

For businesses that are serious about growth, working with experts is rarely just about compliance; it’s about strategy, confidence, and peace of mind. At the end of the day, it’s not only about how much money you save, but also about how much value you create when your finances are handled correctly.