Disclaimer: This article provides general information about tax planner apps for freelancers. For personalized tax advice, please consult a certified tax professional.

Freelancers in India often enjoy the flexibility of working on their own terms, but when it comes to income tax, flexibility doesn’t mean simplicity. From inconsistent income and multiple payment sources to claiming deductions under Section 80C, 80D, and presumptive taxation under Section 44ADA, freelancers face a unique set of challenges during tax season.

Luckily, several tax planning apps have emerged that are tailored to help freelancers track their income, estimate tax liability, and file returns accurately without needing to be a tax expert. This guide lists the top 5 tax preparation apps for independent workers in India that you should be aware of, along with the features that make them stand out.

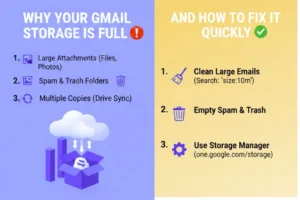

Why Tax Planning Is Crucial for Freelancers

Unlike salaried employees whose TDS is deducted by employers, freelancers need to calculate and pay prepaid tax on their own. Any delay or inaccuracy in this can lead to interest under Section 234B and 234C. Moreover, freelancers can benefit from deductions like home office expenses, internet bills, insurance premiums, and more, but only if they track and plan them throughout the year.

This is where tax planner apps can help. They automate calculations, remind users about deadlines, track eligible deductions, and provide real-time visibility into tax liability. Most importantly, they offer expert assistance if needed, which can be a huge relief for independent professionals juggling multiple gigs.

TaxBuddy: A Smart Tax Companion for the self-employed

TaxBuddy is one of the few apps in India that offers a complete tax planning and filing solution specifically tuned for independent workers and consultants. The platform supports Section 44ADA filing for presumptive taxation, helping users understand when audits are required and when they’re not.

What makes it stand out is its dual approach of automated tax calculation and human expert support. As one of the top tax planner freelancer apps, it allows users to upload invoices, expense proofs, or declare income, and the system takes care of tax estimation. Experts are also available to guide on allowable deductions, GST implications, and advance tax planning.

It even sends reminders before advance tax due dates and helps with TDS reconciliation if payments were received after deduction. All of this makes TaxBuddy an excellent one-stop solution for tax compliance and planning throughout the financial year.

Quicko: Ideal for Freelancers with Investments

Quicko is a modern tax platform designed with a strong focus on tech and integrations. Freelancers who also invest in mutual funds, stocks, or cryptocurrencies will find Quicko especially useful.

The app helps freelancers calculate income under Section 44ADA and compare it with actual profit-and-loss to choose the most tax-efficient route. Its intuitive dashboard shows how much prepaid tax is due, how much has already been paid, and what deductions are still available.

Quicko, as one of the leading tax planning apps for independent workers, also allows integrations with trading accounts and bank statements, making it easy to track income across sources. It’s best suited for the self-employed who are tech-savvy and want complete control over their tax data in a DIY manner.

ClearTax: Great for DIY Filers

ClearTax, one of the popular tax planner freelancer apps in India, is widely known in the market for its self-filing tax solution. While initially more focused on salaried individuals, it has since expanded its offerings to include freelancers and business income under presumptive taxation.

Freelancers who are comfortable navigating tax forms themselves can use ClearTax to enter their income and deductions manually. As one of the widely used Tax management freelancer apps, the platform provides deduction prompts and helps users file ITR-3 or ITR-4, depending on their income type.

While it lacks personalized assistance in free plans, the interface is beginner-friendly. ClearTax also includes calculators for HRA, 80C deductions, and other exemptions, making it a good choice for those who want to explore tax management independently.

myITreturn: A Guided Experience for Beginners

Freelancers who are new to tax filing will find myITreturn’s Q&A-based system easy to use. As one of the user-friendly tax preparation freelancer apps, it avoids showing the full ITR form at once and instead asks questions about your income, clients, expenses, and investments, then auto-fills the return accordingly.

This app is handy for those unsure whether to opt for presumptive taxation or regular books of accounts. It explains both options and recommends the one that results in lower tax liability.

MyITreturn also tracks prepaid tax and allows users to e-pay directly from the application. If you’re a freelancer who doesn’t have a CA and wants a smooth, guided experience, this app makes Tax management approachable.

Tax2win: Expert-Driven with CA Support

Tax2win is known for its CA-assisted model, which works well for the self-employed with high income or complex deductions. As one of the expert-driven tax preparation apps for independent workers, it allows you to book a CA consultation through the application or website, upload your documents, and get your return filed for you.

The service is paid, but it’s worth considering if you want to ensure every deduction is claimed and no errors are made. Tax2win also offers audit support and rectification filing if needed.

The platform supports all ITR forms and gives freelancers the option to file under either Section 44ADA or normal business income, depending on what suits their financial situation.

Feature Comparison Table for Freelancers

| App Name | Section 44ADA Support | Advance Tax Tracking | Expert Help | Best For |

| TaxBuddy | Yes | Yes | Yes | All-in-one planning + filing |

| Quicko | Yes | Yes | No | Tech-savvy users with investments |

| ClearTax | Yes | No | Limited | DIY freelancers are comfortable with forms |

| myITreturn | Yes | Yes | Limited | First-time or guided filers |

| Tax2win | Yes | No | Yes | Freelancers wanting professional support |

What to Look for in a Tax App as a Freelancer

Choosing the right app isn’t just about filing, it’s about year-round planning. Here are some things freelancers should consider:

- Section 44ADA Handling: The application should calculate presumptive income at 50% and warn you if audit conditions apply.

- Advance Tax Alerts: Look for apps that track and remind you of quarterly due dates.

- Expense Tracker: If you file under regular business income, it should let you log expenses like internet bills, software, and travel.

- TDS Handling: Many freelancers receive payments after TDS has been deducted. Choose apps that help you reconcile and claim these credits.

- Expert Access: Unless you’re very confident, opt for a platform that lets you consult a CPA or tax advisor when needed.

- Data Security: Make sure the app encrypts financial data and complies with Indian privacy laws.

TaxBuddy checks most of these boxes and goes a step further by offering assisted services and post-filing support all from a single dashboard.

Conclusion: Plan Smart, File Confidently

As a freelancer, managing taxes doesn’t have to be stressful. The correct tax preparation application for independent workers can help you keep track of your earnings, plan deductions, pay Prepaid tax on time, and file accurate returns, all without needing to visit a consultant.

Whether you prefer DIY platforms like ClearTax and Quicko or expert-supported tools like TaxBuddy and Tax2win, there’s something for everyone. Just make sure the software you choose aligns with your income profile, comfort level, and planning needs.