Disclaimer: This article is for informational purposes only and does not constitute medical, financial, or legal advice. Always consult qualified professionals regarding your specific situation.

Subsistence hunting is core to Alaskan identity, promoting a self-reliant culture that stretches natural resources in remote areas. Hunting for affordable care is, in ways, even more challenging. It’s a situation you may have less control over, given that resources aren’t always available.

The circumstances can be even more bleak as Alaskan premiums are set to skyrocket under Trump’s Big Beautiful Bill- and Alaska already has the highest insurance costs in the nation. But the right financing strategies can support optimal health. Just like your moose hunt, planning ahead can provide you with the tools you need to survive the premium explosion.

Alaska’s Healthcare Crisis

In 2026, thousands of Alaskans who rely on federal subsidies for health insurance will struggle to afford their plans. Enhanced tax credits, enacted in 2022 to help people afford insurance during the COVID epidemic, expired at the end of 2025.

Senators Lisa Murkowski and Dan Sullivan have been trying to extend these subsidies for months, but have come up short. As a result, beginning January 1, 2026, Alaskans will have to pay significantly more for health insurance or give up their plans entirely.

So how bad is it? Nan Schluesner, a human resources consultant in Anchorage, says her monthly premium for a family of three will go from $1,380 to $4,300.

Stanton Gregor, a licensed counselor and Petersburg Borough Assembly member living in the Southeast fishing community, will have to cut back on patient visits to meet the threshold for lower-rate insurance. Otherwise, his current premium for a family of four will jump from $900 to $ 3,500 a month.

There are slim rays of hope, as Alaska will receive $272 million from the federal government in 2026 to upgrade its rural healthcare system, creating lower-cost options and reducing the need for costly travel. Residents are also hoping for a secondary deadline of January 15 for coverage starting Feb. 1, but the prospects are bleak.

Also Read: How Rural Alaskans Access Healthcare: Challenges & Solutions

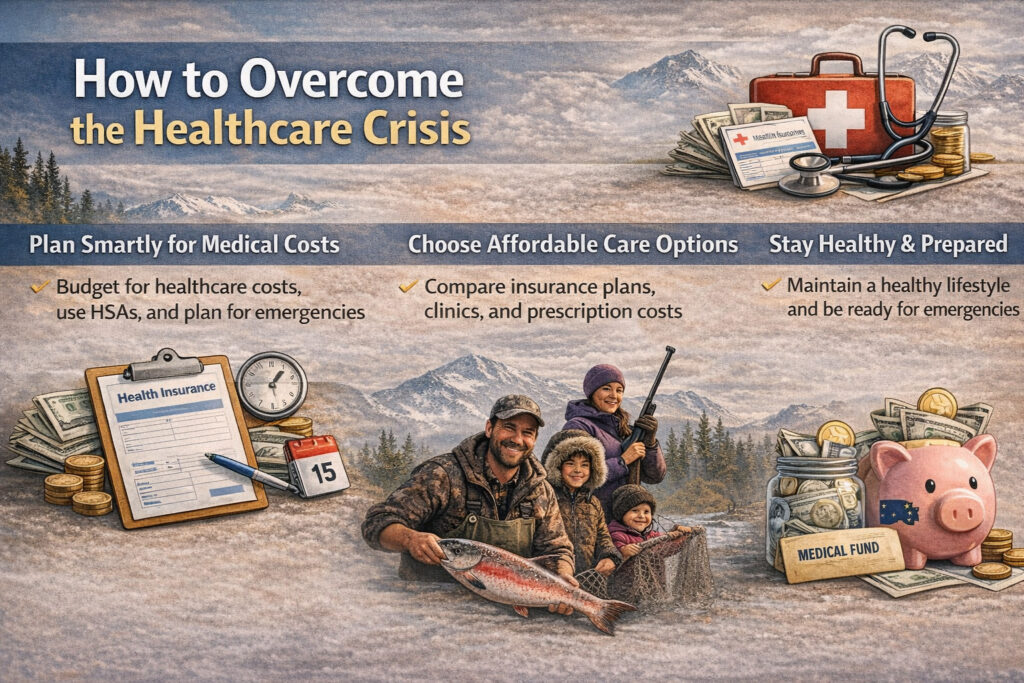

How to Overcome the Healthcare Crisis

The situation is discouraging, but as a resilient, independent culture, Alaskans can devise ways to save on healthcare costs. Here are some suggestions.

Shop the Marketplace

One benefit of the lack of federal subsidies is that it allows families to qualify for marketplace subsidies, even if they are employed. Under the old plan, families who received employer-sponsored insurance could not receive marketplace subsidies, regardless of what their plan offered. Now, families with coverage that costs more than 10% of their household income can qualify for marketplace subsidies, potentially providing access to low-cost insurance.

Max Out HSAs or HRAs for Out-of-Pocket Cost

HSAs and HRAs are a popular way to save on out-of-pocket medical expenses.

- Health Savings Accounts (HSAs): This personal account for deductibles, doctor bills, and copays allows you to invest money tax-free and collect interest. It rolls over year to year, so you can access the money to pay medicare premiums when you retire. Individuals with high-deductible plans can qualify.

- Health Reimbursement Arrangements (HRAs): With this system, your boss gives you money, tax-free, to cover medical expenses. Small businesses typically pay employees directly, while larger companies pay marketplace premiums or expenses. It’s customizable based on age and family size, tax-free for both employers and employees, and cheaper than group insurance.

Take Advantage of Preventive Care

Many Alaskans have health insurance plans that offer low-cost preventative care, such as screenings and vaccines. Not taking advantage of this care leaves money on the table. It also means you are forgoing care that can prevent more expensive issues down the line.

Also Read: Alaska Health Insurance Guide

Some organizations, such as the University of Alaska, offer healthcare rebates to employees who use their preventive care programs. The University expects about a $1.5 million rebate in 2026.

Avoid Unnecessary ER Trips

ER visits are the most expensive type of medical care. If possible, hold off on emergency care and seek primary care, urgent care, or telehealth. These alternatives can also reduce the need for ER visits.

Medical Credit Cards and Financing

Medical credit cards and financing can help you spread your payments over time, making them more affordable. There are various options under medical financing. For example, you could:

- Opt for a company that provides actual credit cards, like Care Credit or Wells Fargo Advantage

- Choose direct financing through companies like Care Credit or Lending Club

- See if your doctor’s office will work out a financing plan. However, most will prefer to work with a credit card or financing company for guaranteed payment.

Compare these providers to determine which is suited to your needs. Consider that many offer limited-time interest-free payments, which could be a deciding factor.

Save on Pharmacy Bills

Pharmacy bills are also getting more expensive. Consumers can expect an estimated 4% cost increase in 2026, though some sources estimate it could reach 13%. But there are ways you can fight back.

For example, you can:

- Ask Your Employer for Better Deals: Many pharmacies are open to working with companies offering bulk discounts for employees. Big groups can save 20% to 40% on medications.

- Use Discount Apps: Apps like GoodRx and Mark Cuban Cost Plus Drugs are online pharmacies that offer drugs at prices 60% to 80% lower than brand-name prices.

- Get Medicare Part D: Disabled people and seniors 65 and over may qualify for Medicare Part D, making them eligible for free and low-cost drugs.

Tap Into Rural Funds

As mentioned earlier, Alaska will receive funds to support rural clinics that may be lower-cost than clinics in urban areas and to reduce commuting expenses. Organizations like the Southcentral Foundation (SCF) and other tribal programs fund these clinics, ensuring Alaskans can access affordable care.

Also Read: Tribal Villages Warn of Hunger Risk as Food Program Funding Cuts Take Effect

Conclusion

A lack of federal subsidies has Alaskans down, but not out. As a resilient culture, you will find the resources to keep your family healthy through financing, local and national programs, shopping around, working with employers, and choosing the right types of care for your needs. Your strong hunting spirit will help your communities weather the storm as true survivors.