Disclaimer: This article is for informational purposes only and should not be considered financial or legal advice. Please consult a qualified professional for advice tailored to your specific situation.

Table of contents

Payroll Software Overview

A successful finance organization is one of the difficulties private companies face in the present, quickly moving digital world. At this stage, finance programming has a significant effect. Computerization of the finance cycle empowers small firms to guarantee accuracy, save time, and focus on tasks crucial to growth. Organizations might acquire assets that help make more valuable and productive activities by exploring the best software for payroll.

Accounting software provides a framework that enhances information security, performs charge computations, and adheres to administrative principles. It goes beyond essentially ascertaining numbers. For private ventures seeking to stay ahead of the competition in a constantly evolving market, finance automation is both a choice and an essential need.

Benefits of Using Payroll Software for Small Businesses

Accounting systems have various benefits. By mechanizing monotonous tasks, organizations can reduce costs associated with manual finance processing and free up resources for other essential organizational tasks. These instruments’ accuracy fundamentally reduces human error, which can prompt expensive fines.

In addition to reducing costs and errors, this software ensures compliance with evolving expense rules. Because of automated systems, organizations can comply with the latest tax requirements and avoid substantial fines. A compelling finance organization promptly influences an organization’s primary concern, which isn’t just a regulatory obligation but also a significant part of its financial strategy.

| Benefit | Description |

|---|---|

| Time Savings | Automates payroll calculations, tax filings, and payslips, reducing manual work. |

| Accuracy | Minimizes human errors in calculations, deductions, and reporting. |

| Compliance | Keeps up with changing tax laws and labor regulations to ensure legal compliance. |

| Cost-Effective | Reduces the need for outsourced payroll services or full-time payroll staff. |

| Data Security | Encrypts sensitive employee data and ensures secure storage and backups. |

| Employee Self-Service | Allows employees to access pay stubs, tax forms, and update personal info online. |

| Scalability | Grows with your business and adjusts to changing payroll needs. |

| Integration | Syncs with accounting, HR, and time-tracking systems for streamlined operations. |

| Reporting and Analytics | Generates payroll reports to support business insights and audits. |

| Accessibility | Cloud-based platforms enable access from anywhere, aiding remote or hybrid teams. |

Finance software is additionally adaptable, permitting small firms to grow without upgrading their infrastructure. One incorporated feature that many arrangements offer is representative self-service portals, which allow workers to access their duty records, pay stubs, and other data easily.

These frameworks ordinarily have broad revealing capacities that provide information on financial costs, assisting organizations in making informed financial decisions. A consistent workflow created through collaboration with other corporate systems, such as bookkeeping or HR software, generally supports productivity.

How to Choose the Right Payroll Software

Choosing the best finance software for your business requires a good fit, like selecting a good pair of shoes. Assessing the nuts and bolts, including financial plan, flexibility, and compatibility with existing frameworks, is fundamental. Consider your business and its specific requirements, whether you’re dealing with basic finance or complex writing about representative advantages and assessments.

Another vital component is the UI and experience. Select programming that is intuitive and easy for your staff to use. Dissecting client criticism can provide insight into how the application functions in real-world business situations. Use test runs to see whether the program meets your organization’s specific needs before buying.

Standard Features of Pay Management Solution Tools

Many elements in the present finance program simplify human assets for executives. Significant highlights include duty documentation, consistency warnings, automated timekeeping, and consistent integration with banking software. Representative self-administration entrances and the executive’s examination offer substantial insights into workforce designs for organizations seeking more advanced solutions.

Accounting systems permit organizations to modify their features to their objectives, which makes it incredibly versatile. Beginning with basic elements and adding more intricate ones as the firm develops can assist private ventures with adapting to the complex effects of moving to a computerized finance framework.

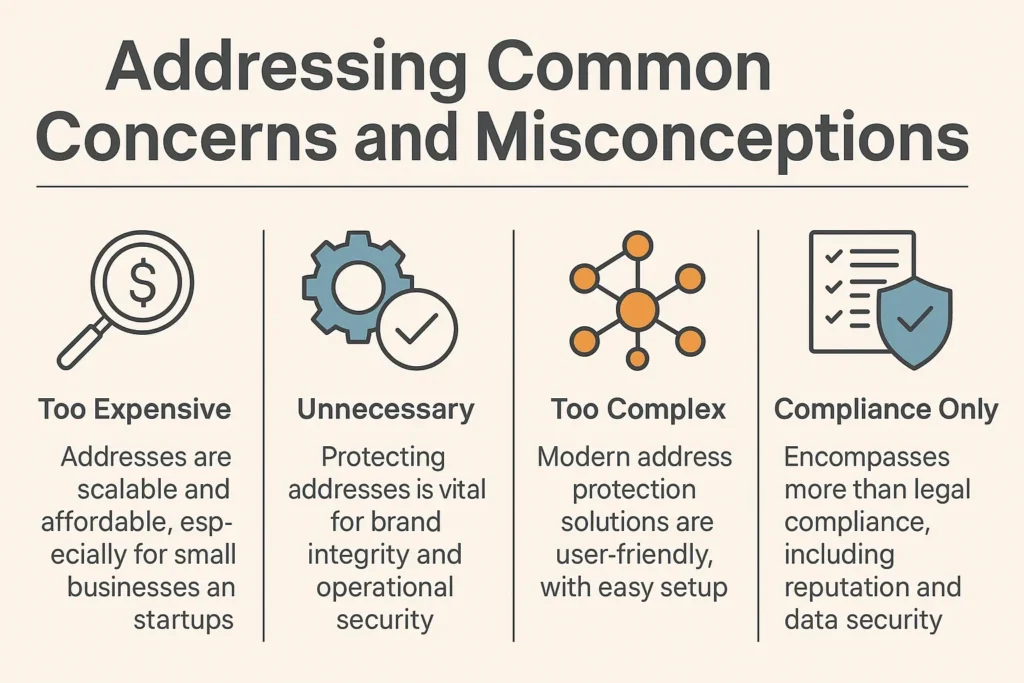

Addressing Common Concerns and Misconceptions

Finance programming enjoys many benefits. However, a few organizations hesitate to use it because they figure it will be excessively expensive or challenging to coordinate. Many are stressed over expected interruptions to their business tasks during the changeover stage. Nonetheless, most programming merchants offer broad help and training resources to guarantee a smooth transition and limit potential downtime.

Changing the perception that accounting software is reasonable for larger organizations is essential. Today, a few sensible decisions are available that are customized explicitly for small ventures. These advances are intended to evolve with the organization, ensuring flexibility and ongoing relevance as needs change.

Top Tips for Seamless Implementation

| Tip | Description |

|---|---|

| Assess Business Needs | Identify specific payroll or bookkeeping requirements before selecting software. |

| Choose the Right Software | Select a solution that aligns with your business size, goals, and compliance needs. |

| Involve Key Stakeholders | Include HR, finance, and IT teams in the planning and rollout process. |

| Plan for Data Migration | Ensure accurate transfer of historical payroll and employee data. |

| Provide Staff Training | Educate employees on how to use the new system efficiently. |

| Set a Realistic Timeline | Allow enough time for testing, integration, and troubleshooting. |

| Ensure Compliance | Verify that the software meets local, state, and federal regulations. |

| Test Before Launch | Conduct a pilot run to identify and fix any issues. |

| Monitor and Adjust | Track performance and user feedback to refine processes post-implementation. |

| Use Vendor Support | Leverage customer service and technical support provided by the software vendor. |

The initial step in joining a fruitful accounting systems program is a deep understanding of current financial tasks. By depicting your current methods, you might identify areas for improvement and enable smoother progress. Representatives should also get broad preparation; becoming used to the new framework cultivates trust and lessens resistance to change.

Utilize seller assets. Most solid sellers often offer illustrations and client service to help with any first issues. Worker information may be used to recognize client experience issues immediately, considering speedier arrangements and expanded operational efficiency.

Testing the program in a controlled climate before full establishment can help recognize expected issues and guarantee similarity with current frameworks. Assigning a specific undertaking group or resource to the joining system might facilitate departmental joint effort and communication.

Defining clear objectives and courses of action for the organization ensures that everyone knows their responsibilities and the expected results. Following execution, the framework might be routinely inspected and upgraded to improve performance and adapt to evolving financial needs. To wrap up, commending victories during the incorporation cycle might lift everyone’s spirits and feature the coordinated effort expected for an effective reception.

Future of Salary Administration Tool In Small Businesses

Progresses in man-made brainpower and AI will further develop finance processes, giving finance programming and bookkeeping services a splendid future. These innovations will anticipate work designs, automate more complex processes, and provide vital insights to help organizations make decisions.

As independent ventures become increasingly data-driven, accounting software and bookkeeping services will be vital for leveraging this data to achieve operational benefits. Because of ongoing improvements and upgrades, these advances will remain open, productive, and in sync with the evolving needs of modern operations.