Running a business is exciting! It’s your dream, your passion, and your path to success. But let’s be honest; it can also feel risky sometimes. You may worry about unexpected costs, keeping up with the competition, or even something as simple as a computer crashing and losing important data.

These are all valid concerns, and that’s where risk management comes in. It’s not scary or complicated; it’s actually like putting a safety net under your tightrope—a way to prepare for bumps in the road and keep your business thriving. We’ll explore how to mitigate risk, what risks businesses typically face, and the simple steps you can take to avoid them.

Types of Risks in Business

No business operates in a perfect bubble. Every venture faces inherent challenges, and understanding these potential risks is crucial for building a resilient and successful company. These risks are categorized into five main areas:

Here are the five main types of risk mitigation to be aware of:

- Strategic Risks: These are the “big picture” challenges that could impact your business goals. A new competitor emerges technology disrupts your industry, or customer preferences shift unexpectedly.

- Compliance Risks: Every business operates within a web of regulations. Please comply with these rules to avoid fines, legal trouble, and even shutdowns.

- Financial Risks: This is all about the money – keeping it flowing and avoiding unexpected cash flow problems. Economic downturns, bad debts, or even a simple pricing mistake can all be financial risks.

- Operational Risk: These everyday hiccups can disrupt your business flow. Examples include equipment breakdowns, inefficient processes, and human errors.

- Reputational Risks: Your reputation is your business’s good name. Adverse publicity, product recalls, or even unhappy customer reviews can damage your reputation and sales.

Simple Yet Effective 7 Risk Mitigation Strategies For You

There are simple risk and mitigation strategies you can take to reduce many risks and ensure your business thrives. Here are seven easy-to-implement strategies to mitigate common business risks:

1- Conducting a SWOT Analysis

This framework stands for Strengths, Weaknesses, Opportunities, and Threats. Analyzing these internal and external factors gives you a clear picture of your business’s landscape. A thorough SWOT analysis helps you identify potential risks associated with your weaknesses and threats, allowing you to make strategies to capitalize on your strengths and opportunities.

2- Developing a Risk Management Plan

Once you’ve identified potential risks through your SWOT analysis, it’s time to create a battle plan. This risk management plan should:

- Categorize risks: Group risks based on their likelihood and potential impact on your business.

- Develop mitigation strategies: For each risk, outline actions to minimize or eliminate its impact. This could involve diversifying your product line, investing in cybersecurity, or building strong supplier relationships.

- Assign ownership: Designate a responsible person or team to monitor and implement each mitigation strategy.

- Review and update regularly: Your risk management plan should be a living document because the business world is competitive.

3- Importance of Diversification

Don’t put all your eggs in one basket! Diversification is a powerful tool for mitigating risk. This could involve:

- Product or service diversification: Expand your offerings to cater to a broader audience or reduce dependence on a single product line.

- Market diversification: Explore new customer segments or geographic regions to lessen your vulnerability to fluctuations in one specific market.

- Supplier diversification: Don’t rely solely on one supplier for crucial materials or services. Build relationships with multiple vendors to ensure continuity in case of disruptions with a single source.

4- Scenario Planning

Imagine the “what ifs?” Scenario planning involves considering different future possibilities, both positive and negative. You can develop contingency plans to address unexpected situations by brainstorming potential scenarios. This proactive approach allows you to be adaptable and prepared to face unforeseen challenges.

5- Embrace Budgeting and Cash Flow Management

Financial stability is the foundation of a resilient business. Create a business plan and budget that tracks income and expenses and closely monitors your cash flow. This lets you identify potential shortfalls early on and adjust to avoid financial pitfalls.

6- Invest in Quality and Security

Cutting corners on equipment or cybersecurity can backfire. Invest in reliable equipment that minimizes the risk of breakdowns. Similarly, prioritize robust cybersecurity measures to protect your data and customer information from cyberattacks.

7- Build Strong Customer Relationships

Loyal customers are your biggest asset. Focus on delivering excellent customer service, building trust, and addressing concerns promptly. Positive word-of-mouth from happy customers can mitigate the impact of negative reviews or setbacks.

Pro tip: Stay Up-to-Date- The business world is constantly evolving. This allows you to adapt your strategies to changing circumstances and avoid being caught off guard by unexpected developments.

Similarly, risk mitigation examples include installing fire alarms and sprinklers to prevent fire damage and diversifying investments to reduce financial loss. Both actions help minimize potential negative impacts.

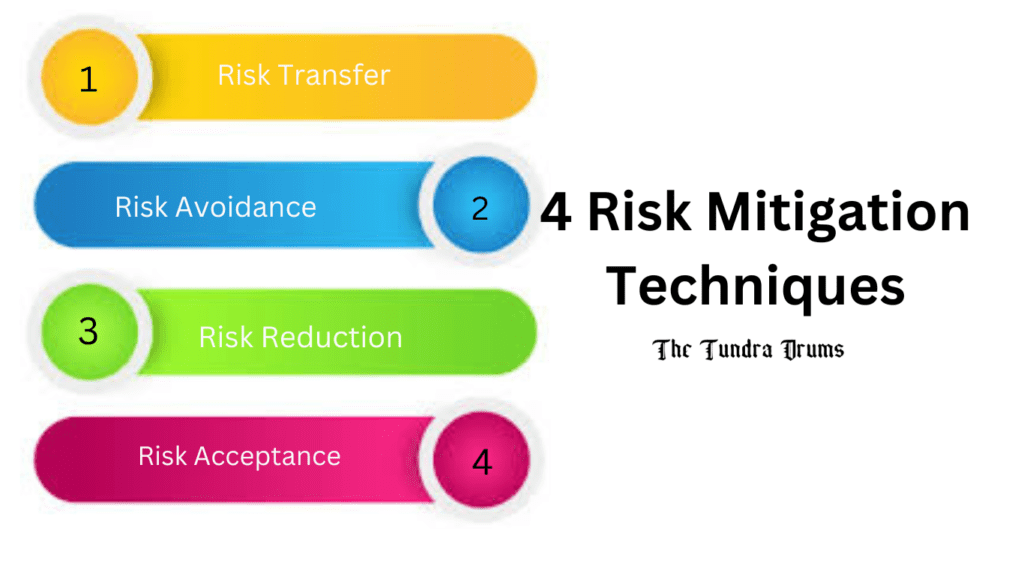

4 Risk Mitigation Techniques

Every business owner faces uncertainty. Unexpected events, from economic downturns to product liability lawsuits, can threaten your company’s stability. But fear not! Risk mitigation strategies protect against these uncertainties, allowing you to minimize potential damage proactively. Here are the four main approaches to risk mitigation:

1- Risk Transfer

Sometimes, the best defense is a good offense. The most common way to achieve this is through insurance. By purchasing insurance, you transfer the economic risk of certain events, like property damage or lawsuits, to the insurance company. In exchange, you pay a premium.

Other forms of risk transfer include outsourcing tasks to vendors who may be better equipped to handle specific risks or forming joint ventures to share the burden of potential challenges.

2- Risk Avoidance

Risk avoidance is the most straightforward approach. It involves simply eliminating the activities or situations that carry a potential risk. For example, a small bakery might only offer delivery services if they can guarantee product freshness during transport.

While effective, risk avoidance can sometimes limit growth opportunities. The key is to weigh an activity’s potential benefits against the associated risks and choose to avoid only those risks that pose a significant threat.

3- Risk Reduction

This approach acknowledges that some risks are unavoidable. Risk reduction focuses on minimizing the likelihood or impact of those risks. Let’s revisit the bakery example. While they might avoid delivery altogether, they can implement risk reduction strategies like investing in insulated delivery bags or partnering with a reliable local delivery service to minimize the risk of product spoilage during delivery.

Other risk reduction techniques include implementing robust cybersecurity measures to prevent data breaches, regularly maintaining equipment to avoid breakdowns, or establishing clear safety protocols to minimize workplace accidents.

4- Risk Acceptance

Not all risks are created equal. Some pose such a low probability or potential impact that it’s simply not cost-effective to mitigate them. Risk acceptance involves acknowledging these low-level threats and choosing to live with them.

For example, a small business owner might accept the risk of a minor power outage because the cost of installing a backup generator outweighs the likelihood and potential impact of a short power cut. The key to risk acceptance is to carefully assess the potential consequences and ensure they are tolerable before deciding to accept the risk.

FAQs

How can you mitigate the potential risk associated with mitigated control?

To mitigate potential risks, implement robust monitoring systems and establish clear protocols for rapid response. Regularly review and update risk management strategies to adapt to evolving threats.

What does it mean to mitigate risk?

Mitigating risk means taking actions to reduce the likelihood or impact of potential adverse events. This involves identifying risks and implementing strategies to manage and minimize them.

How can small businesses effectively manage risks?

Small businesses can effectively manage risks by conducting regular risk assessments to identify potential threats and implementing mitigation strategies such as diversifying suppliers, investing in insurance, and creating contingency plans. Additionally, they should maintain strong cybersecurity measures and ensure compliance with legal and regulatory requirements.