Revolut, a digital-only financial institution, is being criticized for its security measures after a customer lost £165,000 to fraud. Jack, a business owner, had his account compromised despite Revolut’s advertised security features.

Jack’s ordeal began with a call from scammers posing as Revolut representatives. They claimed his account was vulnerable due to shared Wi-Fi. Jack provided information, unknowingly granting scammers access to his account.

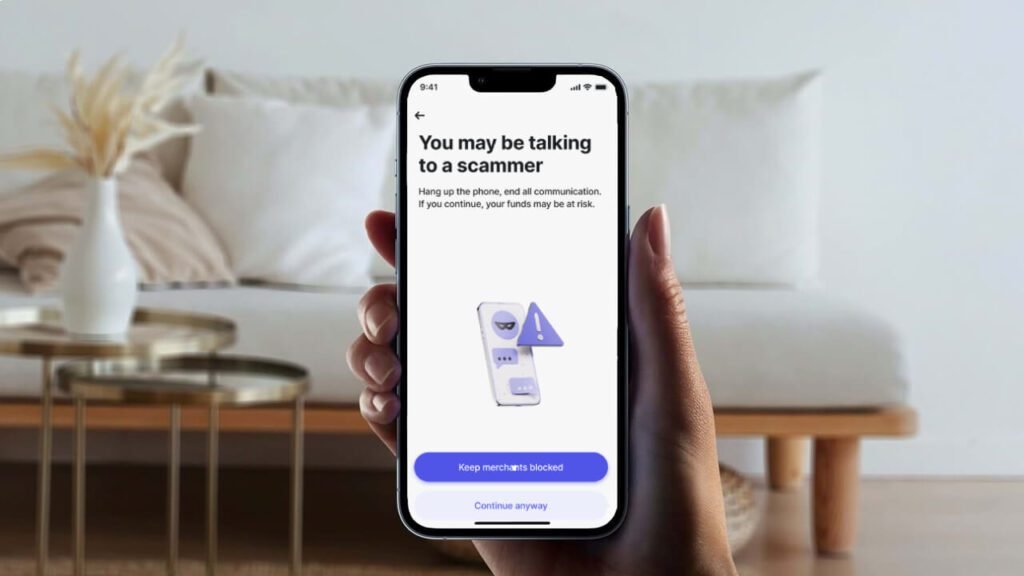

Revolut’s system allowed the scammers to set up new payees and authorize transactions without additional verification. Jack approved three payments, unaware they were fraudulent. Thousands of pounds were transferred within an hour.

Jack contacted Revolut via the app’s chat function, but it took 23 minutes to reach the department. By then, another £67,000 had been stolen, and Revolut refused to refund the £165,000.

Experts argue that Revolut’s systems failed Jack. Facial recognition software was bypassed, and 137 transactions to new payees didn’t raise concerns.

Revolut Fraud Vulnerability is a growing concern. According to Action Fraud, Revolut was named in nearly 10,000 fraud reports last year, exceeding banks like Barclays.

Former employees cite Revolut’s focus on growth over security. “Protecting Revolut from financial crime played second fiddle to launching new products,” one insider revealed.

Revolut claims to have invested heavily in financial crime prevention and has a “high-performance culture.” However, the Financial Ombudsman Service received 3,500 complaints about Revolut in 2023.

New rules now require banks to reimburse fraud victims up to £85,000. Revolut Fraud Vulnerability remains a concern, with experts advising caution when banking with the firm.

According to Revolut, investigations on each potential fraud case are underway.