Alaska’s real estate market does not behave like the rest of the Lower 48. Prices, rental demand, maintenance costs, and even buyer psychology are shaped by climate, remoteness, tourism cycles, and access to infrastructure. Investors who treat Alaska like a typical U.S. market often misjudge risk, returns, or timelines.

This guide breaks down where real estate investment works best in Alaska, city by city, with a clear focus on investment behavior, not hype. Instead of generic advice, each location is evaluated based on demand drivers, income potential, and structural risks that investors actually face.

8 Best Real Estate Investment Opportunities in Alaska

- Anchorage

- Fairbanks

- Juneau

- Sitka

- Cooper Landing

- Delta Junction

- Wasilla

- Homer

1. Anchorage

Anchorage is Alaska’s largest and most economically diverse city, making it the state’s most stable long-term real estate market. Rental demand is driven by government employment, healthcare, logistics, and tourism, which cushions the market against extreme volatility.

| Anchorage Rent | Value |

| Median Rent | $1,900 |

| Month-Over-Month Change | +$50 |

| Year-Over-Year Change | +$70 |

| Available Rentals | 354 |

Strengths

- Stability in Diversity: Anchorage’s economy, bolstered by industries such as oil and gas, tourism, and government services, ensures consistent rental demand. The city welcomed 2.7 million visitors between May 2022 and April 2023, further solidifying its economic stability.

- Cultural and Recreational Attractions: The city’s proximity to outdoor activities such as hiking and wildlife viewing, combined with cultural events and festivals, attracts residents and tourists. These phenomenal factors enhance property value and rental opportunities.

- Investment Potential: With average monthly rents around $1,900, investors can expect competitive yields supported by a growing population and tourism sector.

Challenges

- Economic Dependency: Anchorage’s economy relies heavily on oil prices and government spending, making it susceptible to fluctuations in those sectors.

- Competitive Market: The real estate market in Anchorage can be competitive, requiring careful market analysis to identify properties with solid investment potential.

- Infrastructure Concerns: Some areas of Anchorage face infrastructure challenges, which could affect property values and renters’ appeal.

Best for: Buy-and-hold investors seeking predictable rental income

2. Fairbanks

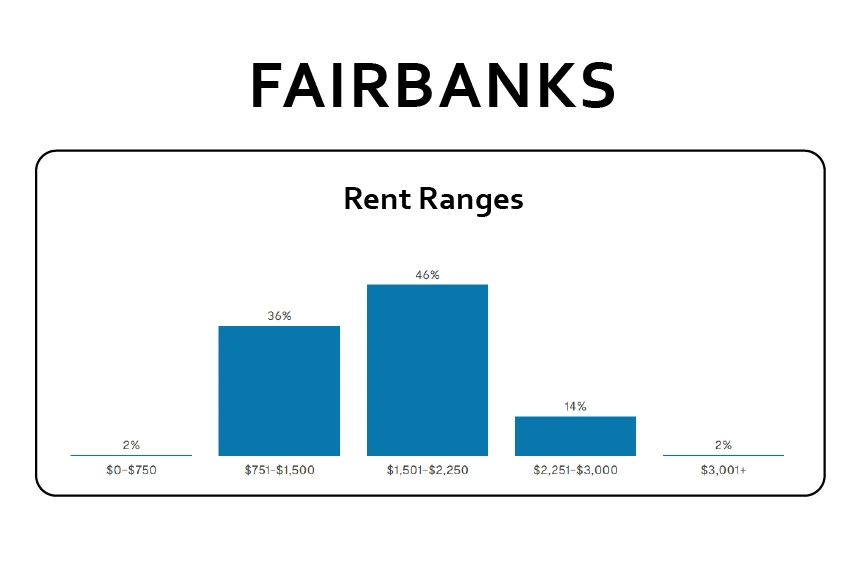

Fairbanks offers lower entry prices than Anchorage but comes with higher climate-related operating costs. Rental demand is supported by the military, healthcare, education, and tourism tied to the Northern Lights.

Cash flow can be attractive, but winters raise costs. Home prices in Alaska saw a 2.2% increase in May 2024 compared to the previous year, but you can find lower prices in Fairbanks than in bigger cities. This affordability makes Fairbanks a meaningful real estate investment opportunity in Alaska, especially for first-time investors or those expanding their portfolios.

Investor Reality: Fairbanks works best for investors who balance affordability with maintenance planning.

The Fairbanks real estate includes:

- Multi-unit apartment buildings

- Single-family homes

- Commercial properties

Also Read: Fairbanks Real Estate in 2025: A Hidden Gem for Savvy Investors?

Strengths

- Lower purchase prices compared to Southcentral Alaska

- Stable employment sectors beyond tourism

- Steady long-term rental demand

Challenges

- Extreme winters increase heating and maintenance expenses

- Slower appreciation compared to Anchorage

- Seasonal variation in short-term rentals

Best for: Budget-conscious investors focused on long-term rentals

3. Juneau

Juneau’s real estate market is shaped by its role as Alaska’s capital and its geographic isolation. Demand is driven by government workers and seasonal tourism, while supply remains constrained by land constraints.

Investor Reality: Juneau favors low-turnover rentals, not rapid expansion. Entry costs are higher, but vacancy risk is relatively low.

Strengths

- Consistent demand from government employees

- Strong short-term rental demand during the tourism season

- Limited housing supply supports pricing

Challenges

- Seasonal income swings

- Higher logistics and property management costs

- Limited expansion opportunities

Best for: Investors prioritizing occupancy stability over rapid scaling

4. Sitka

Sitka offers a serene coastal retreat rich in cultural history and natural beauty. Its appeal comes from stunning scenery like towering mountains, pristine coasts, and chances for growth and development. Yet, being a remote location, logistical challenges and seasonal economic fluctuations are considerations for potential real estate investors in Stika. However, the charm and potential for property appreciation make Sitka a compelling choice for those seeking unique real estate opportunities.

Strengths

- Natural Beauty: Sitka’s stunning coastal landscapes and outdoor recreational opportunities attract nature enthusiasts and adventure seekers, boosting demand for vacation rentals.

- Historical Significance: Rich in Native American and Russian history, Sitka’s historical sites and cultural events contribute to its appeal as a tourist place and rental market.

- Appreciation Potential: Sitka’s limited inventory and high demand for waterfront properties create opportunities for property appreciation and rental income.

Challenges

- Remote Location: Sitka’s remote location presents logistical challenges for property management and may impact investor accessibility and operational costs.

- Seasonal Tourism: Like other coastal towns, Sitka experiences seasonal fluctuations in tourism, affecting rental occupancy rates and income potential.

5. Cooper Landing

Cooper Landing is the place to be if you love Alaska’s rugged landscapes. It’s also known for fishing and hiking, attracting tourists seeking peace and nature. Because of this, vacation rentals are in high demand, especially during busy times.

Strengths

- Outdoor Appeal: Cooper Landing’s proximity to the Kenai River and scenic wilderness draws outdoor enthusiasts year-round.

- High Rental Demand: Limited lodging options drive short-term rental demand, resulting in high occupancy rates.ho

Challenges

- Seasonal Fluctuations: Depending heavily on tourism leads to income variability, requiring careful financial planning.

- Remote Location: Limited access to amenities and services poses maintenance and guest satisfaction challenges.

Investing in Cooper Landing promises rewarding returns, but strategic planning and flexibility are essential to effectively navigate its seasonal economy and the challenges of its remote location.

6. Delta Junction

Delta Junction is a place to consider for real estate investment, especially if you love nature and the outdoors. Located in the Interior region of Alaska, this area is known for its beautiful scenery, making it a popular spot for outdoor enthusiasts and tourists. Here’s what makes Delta Junction an attractive place for real estate investors:

Strengths

- Natural Beauty: The picturesque landscape attracts tourists and outdoor enthusiasts, making vacation rentals in demand.

- Tourism: The influx of tourists boosts demand for short-term rentals, creating a steady income stream.

- Growing Demand: The strategic location along the Alaska Highway creates a constant demand for residential and commercial properties.

Challenges

However, investing in Delta Junction also comes with its own set of challenges:

- Remote Location: Being in a remote area can pose challenges, such as limited access to amenities and services.

- Weather Conditions: The harsh winter weather in Delta Junction can be tough on properties and require extra maintenance, ultimately increasing costs.

- Market Fluctuations: The need for vacation rentals can vary seasonally, affecting your income during off-peak times.

- Infrastructure Development: While the scenic beauty is a draw, the infrastructure may not be as developed as in more urban areas, potentially impacting property values and ease of access.

7. Wasilla

In Southcentral Alaska, Wasilla is a good but challenging place for real estate investors. Its growing population and proximity to Anchorage offer numerous residential and commercial property opportunities. However, it also presents some hurdles that must be considered while investing.

Why Invest in Wasilla?

Wasilla has a lot to offer:

- Growing Population: More people are moving to Wasilla, driving higher demand for homes and businesses. Ultimately, this creates good opportunities for real estate investors.

- Close to Anchorage: Just a short drive from Alaska’s largest city, making it convenient for commuters.

- Recreational Amenities: With excellent fishing, hiking, and other outdoor activities, it’s an attractive spot for vacation rentals.

Types of Investments

Here are some examples of what you can invest in:

| Type of Investment | Description |

| Housing Developments | You can build new homes to meet the growing demand. |

| Rental Properties | Owning apartments or houses to rent out to families and individuals. |

| Mixed-Use Spaces | Combining residential and commercial spaces, like apartments above shops. |

Strengths

- High Demand: More people mean more need for housing and services.

- Tourism Appeal: Outdoor activities attract tourists, making vacation rentals profitable.

- Proximity to Anchorage: Easy access to a larger city can attract commuters and businesses.

Challenges

- Weather: Harsh winters can be brutal on properties and may require more maintenance.

- Market Fluctuations: Property values can change, so staying informed is essential.

- Limited Infrastructure: As a smaller town, Wasilla may have fewer amenities than a larger city.

8. Homer

Homer, Alaska, is the place for your next investment in real estate! It’s a charming town on the beautiful Kenai Peninsula, attracting tourists, artists, and nature lovers. It contains some challenges and hurdles for inventors, but is known for its unique environment. Here’s what makes Homer unique for investors:

- Picture Perfect Location: Imagine cozy cabins with stunning ocean views! Homer’s beauty makes it a popular vacation destination. This translates to the potential for substantial rental income from vacation rentals.

- Arts & Culture Hub: Homer boasts a thriving arts scene, including galleries, studios, and shops. Thus, investing in commercial space could mean renting to these creative businesses.

- Something for Everyone: Homer offers a variety of properties. Whether you want a beachfront getaway or a charming downtown property, there could be something for

Strengths

- High Tourist Appeal: A steady stream of visitors means potential for consistent rental income, especially during peak seasons.

- Unique Local Vibe: Homer offers a special charm that attracts a specific type of visitor and resident. This can create a niche market for your rentals.

Challenges

- Seasonal Fluctuations: Homer’s tourism industry thrives in the summer, but rental income might be lower during winter.

- Remote Location: Homer is off the beaten path. While this adds to the charm, it also means a smaller pool of potential tenants or commercial renters.

Common Investor Mistakes in Alaska Real Estate

Many underperforming investments in Alaska result from misaligned expectations, not bad locations.

Most frequent mistakes include:

- Overestimating year-round rental demand

- Ignoring seasonal income variability

- Underbudgeting for weather-related maintenance

- Failing to research zoning and rental regulations

- Choosing scenic locations without demand analysis

- Overleveraging in low-liquidity markets

Pro Insight: Successful investors match city behavior to their investment strategy, not the other way around.

Also Read: Facts, Pros, And Cons of Living in Alaska in 2025

Conclusion

Alaska real estate is not a single market. Each city rewards a different type of investor. Anchorage favors stability, Fairbanks favors affordability, Juneau favors occupancy security, and smaller towns reward niche strategies rather than scale.

Investors who understand local demand drivers, climate impact, and liquidity limits are far more likely to achieve sustainable returns than those chasing generalized real estate trends.