Disclaimer: This article is for informational purposes only and does not constitute legal or financial advice. Prenuptial agreements have significant legal and financial implications. Always consult a qualified family law attorney or financial professional before making decisions regarding your personal situation.

Want to get married?

Hold up. Before you take that big step…there’s something you should do first. It’s called a prenuptial agreement. Yeah, it doesn’t exactly sound romantic… But it might be one of the smartest moves you and your partner make. Here’s the thing:

Almost 41% of first marriages end in divorce. Granted, nobody enters a marriage thinking it will end that way. But having a plan in place that protects both partners is essential.

Prenups used to be just for the 1%…the celebrities and the rich and famous. Not anymore. Prenuptial agreements are becoming a sensible option for couples across the board who want some clarity before they tie the knot. And as people marry later in life, they’re bringing more assets into a marriage than ever before.

In this article:

- Why Are Prenuptial Agreements Becoming More Common?

- Benefits of a Prenuptial Agreement

- Everyday things to include (and not include)

- Initiating the discussion

Why Are Prenuptial Agreements Becoming More Common?

It used to be that a prenup had the social stigma of throwing cold water on your wedding plans.

Prenups = distrust. Wedding-planning sabotage. Planning for failure.

Not today. Recent surveys find that 15% of married or engaged people have entered into a prenup. That’s three times as many as just a decade ago, when only 3% had done so, according to a Harris Poll survey. And among younger couples, the trend is accelerating.

One 2023 Axios report found that 47% of millennials who have been married or engaged signed a prenup. It’s 41% for Generation Z. Of course, you need experienced legal services from a family law firm to handle such matters. Organizations like Greenwood Law offer professional advice when establishing a prenup for your relationship.

But there’s another key factor at play here as well… Both of those generations are marrying later than previous generations. Millennials in particular are bringing more to a marriage because they’re further along in life. This can mean student loans and other debt they want protected.

But there’s a big pile of pre-marriage assets many of them are bringing too:

- Retirement accounts

- Equity in their homes

- Investments

- Inherited property

- Start-up businesses or shares of a business

- Intellectual property (books, music, art, etc.)

- Financial portfolios

Makes sense when you think about it, right?

Wait longer to get married = more premarital assets to protect. This is especially true as home prices rise, college debt skyrockets, and more people own small businesses.

The Real Benefits of a Prenuptial Agreement

A prenuptial agreement is really no different than insurance for your marriage. Do you get car insurance because you plan to get into an accident? No. But you get it because if something unexpected happens, you’re covered. Think of a prenup in the same way.

It’s peace of mind for both of you. But beyond that, it can provide you with these specific benefits:

- Protect premarital assets in the event of divorce

- Shield you from a spouse’s debt (credit cards, student loans, etc.)

- Simplify divorce proceedings (the two of you have already agreed on major financial issues)

- Protect your business (shareholders can avoid conflict if a spouse tries to take part in the business)

- Clarify and define financial expectations

And did you know this, too?

A prenup can actually strengthen your relationship. That’s because to have the discussion, you’re already having some of the most challenging money conversations before the wedding.

Financial concerns are one of the biggest causes of divorce. If you can talk about them early, the chances of success skyrocket.

What Can (and Can’t) Be Included in a Prenuptial Agreement

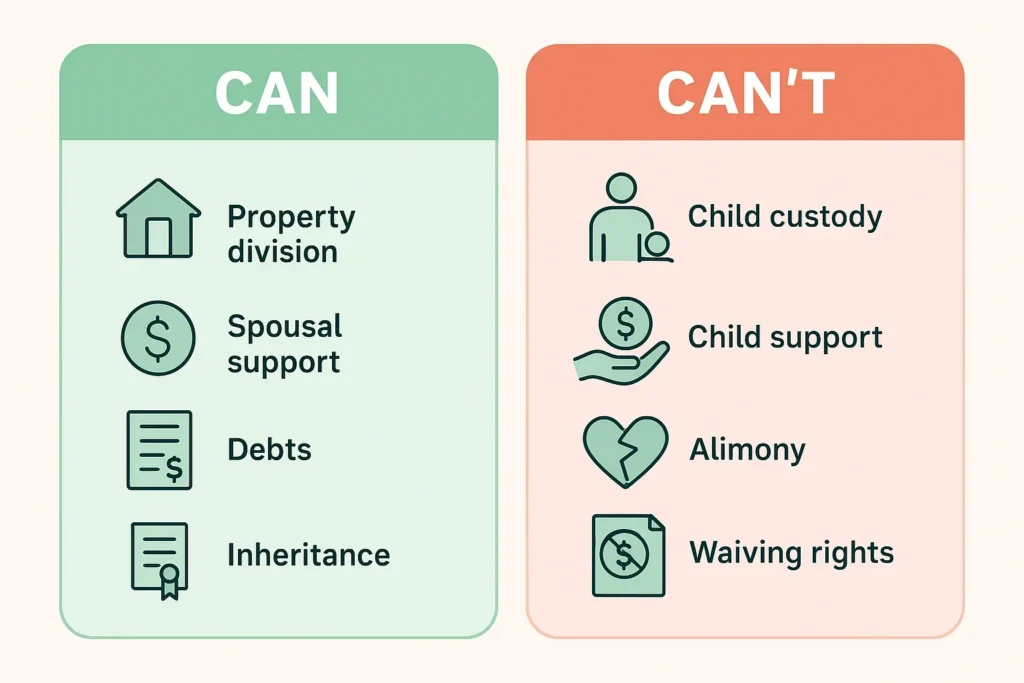

In a prenup, there’s a lot you CAN address:

- Property and asset division

- Alimony terms (spousal support if the marriage ends)

- Debt allocation

- Inheritance protections

- Business ownership

- Financial responsibilities during the marriage

A lot. But there are some specific things that you CAN NOT include as well:

- Child custody (you can’t address this in a prenup)

- Child support (also off limits)

- Illegal or unethical provisions (naturally)

- Behavioural clauses (anything that has to do with what you expect a partner to “behave” like)

- Clauses that incentivize divorce

The key thing to know here is that courts aren’t going to enforce anything in a prenup involving children. Custody, support, etc., is determined at the time of divorce based on the child’s best interest.

So not in advance of the marriage in a contract. Also, both parties must have separate legal representation when drafting the agreement. The last thing you want is a judge overturning your prenup because your partner didn’t have their own legal counsel. Hiring the right divorce lawyers from a local law firm or family law firm will make sure everything is done right the first time.

Also Read: Effective Strategies for Navigating Divorce and Custody Challenges

How to Make Sure Your Prenup Holds Up

Not all prenups are created equal.

For a prenuptial agreement to be legally enforceable, several key requirements must be met. First, the agreement must be in writing, as the courts do not recognize verbal contracts. Both parties must sign the prenup voluntarily, without coercion or pressure. Full financial disclosure is essential, meaning that all assets, debts, and relevant financial information must be transparently shared. The agreement should be presented promptly, rather than sprung on a partner at the last minute before the wedding. Finally, each party must have its own legal representation, ensuring that both individuals receive independent advice and fully understand the terms of the contract.

It’s pretty straightforward. But the thing courts look at the most is transparency. Were both parties clear about what they were signing?

If there’s an appearance of any coercion or unfairness, the agreement can be rendered null and void. Remember, give yourselves time. It’s never a good idea to rush a prenup.

Initiating the Discussion

We all know this is where most couples get hung up.

Talking about a prenup feels wrong. It’s like you’re planning for the marriage to fail when you haven’t even gotten to first base yet.

But if you have a family law attorney helping you, this conversation goes better when you do it the right way.

- It’s mutual protection, not a negotiation. A prenup doesn’t benefit one partner over the other. Both parties walk away better protected.

- Bring it up early. Toss out the “we need to talk” idea. Do it in the beginning. Get it out there.

- Be honest with your concerns. What’s bothering you about not having a prenup? Is there a ton of premarital assets you need to consider? Messy divorces in your family history? The only way you two get on the same page is by laying it all out there.

- Listen to your partner. They might have concerns as well. But again, it’s a conversation, not a demand.

- Remember why you’re doing it. This is a way to protect both of you. That’s a positive.

- Find a reasonable attorney. If you want this to go well, you’ll need an experienced family law firm or divorce attorney. They’ll help you navigate this conversation better.

Also Read: Common Mistakes to Avoid When Choosing Divorce Lawyers

It can be an awkward discussion. But consider this…Couples who can work through tough financial conversations before the wedding are more equipped to weather future storms. Plus, if this conversation is a “deal breaker” for one of you… Well, it’s probably a good thing to know before the two of you make a significant legal and financial commitment to one another.

Wrapping It Up: Prenuptial Agreements and Why They’re Worth a Conversation

Prenuptial agreements aren’t about planning for divorce. They’re about being smart. Prepared. And above all, protective of both you and your partner. Just like insurance, you hope you’ll never need it. But if you do, you’ll be so glad you took the sensible step of having a plan.

Look, the statistics show more couples are getting prenups than ever before. And the feedback from divorce financial analysts who see the good and bad outcomes of marriages confirms the benefits. 63% of divorce financial analysts believe that prenuptial agreements help reduce contentious court cases when marriages end.

That’s a win for everyone.

A prenuptial agreement can serve many valuable purposes, whether you bring substantial assets to the marriage or want to clarify your financial expectations. Talk to an experienced family law attorney. Initiate the conversation with your partner. And do what’s best for both of you. You’ll thank yourself later.