Disclaimer: This article is for informational purposes only and does not constitute financial, legal, or tax advice. Readers are encouraged to consult with qualified professionals before making decisions related to location-based incentives or business expansion strategies.

For companies expanding across state lines, location is more than just a strategic decision; it’s a financial opportunity. In the United States, state and local governments offer a range of location-based incentives to attract business investment and job creation. These include tax credits, cash grants, infrastructure support, and workforce development reimbursements, which can directly impact a company’s return on investment (ROI).

While these programs are designed to stimulate regional economic growth, they also offer a significant advantage to employers who understand how and where to leverage them. Yet many organizations, especially those growing rapidly or managing operations in multiple states, overlook these incentives entirely or claim only a fraction of what they’re eligible for.

From CFOs managing expansion budgets to HR leaders focused on hiring goals, understanding geographic incentives is no longer optional. It’s a competitive edge.

In this article, we’ll break down the key types of ROI Based incentives, common pitfalls that reduce ROI, and how companies, particularly in high-growth sectors like technology and healthcare, can proactively align these opportunities with their long-term business strategy.

What Are Location-Based Incentives?

Geographic incentives are financial benefits that federal, state, or local governments offer to encourage businesses to operate, expand, or hire in specific geographic areas. These programs are designed to boost economic activity, create jobs, and attract long-term investment in targeted regions.

| Incentive Type | Description | Examples of States Offering |

|---|---|---|

| WOTC (Work Opportunity Tax Credit) | Federal tax incentive for hiring individuals from target groups | All states (administered federally) |

| Opportunity Zones | Capital gains tax incentives for investment in designated areas | TX, FL, OH, GA, SC, NC |

| TEF (Texas Enterprise Fund) | Cash grants for projects offering significant job creation | Texas |

| Sales/Use Tax Exemptions | Waivers for equipment, R&D, and manufacturing | IN, TN, NC, AZ |

| Job Creation Tax | Per-job tax based on wage and location | GA, AL, MS, KY |

| Training Grants | Reimbursement or funding for workforce training | LA (FastStart), SC, NC, TX |

Common Types of Location-Based Incentives

- Tax Credits: Reductions in a company’s tax liability for meeting certain conditions, such as hiring local workers, investing in property or equipment, or relocating to a designated zone.

- Cash Grants: Direct funding awarded to businesses for job creation, training programs, or capital investment, often tied to performance milestones.

- Workforce Development Support: Subsidies or reimbursements for employee training, often coordinated through local workforce boards or technical colleges.

- Infrastructure Assistance: Financial support for utilities, roads, or facility improvements needed to support a business operation in a chosen location.

- Property Tax Abatements: Temporary reduction or elimination of local property taxes, often used to encourage development in underutilized areas.

Who Offers These Incentives?

- State Governments: Most U.S. states run economic development programs with targeted incentives to attract industries aligned with their growth priorities.

- Local Governments and Municipalities: Cities and counties often layer on their incentives, especially in areas with higher unemployment or underdevelopment.

- Federal Programs: Although less common at the federal level, programs such as the Work Opportunity Tax Credit (WOTC) and Opportunity Zones continue to play a role in location-based planning.

But why should companies, especially those operating across multiple states, prioritize business relocation incentives in the first place? Let’s look at what’s at stake.

Incentives vary widely, not only by state but also by industry, workforce size, and type of investment. Businesses that understand these differences can align expansion and hiring strategies to take full advantage of what’s available.

Why Multi-State Employers Should Care

For companies with operations in more than one state, or those planning to expand, business relocation incentives represent more than a bonus. They’re a competitive tool that can directly impact cost structure, hiring decisions, and long-term profitability.

Tangible Financial Impact

Location-based programs can reduce business costs in specific regions by covering a range of expenses, from tax liabilities to training costs. For example, a company opening a new facility in a designated job creation zone may qualify for state income tax rebates, local property tax abatements, and even wage subsidies for new hires.

When these benefits are aggregated across multiple locations, the savings can be substantial. In some cases, incentives can cover up to 10–15% of total project costs, effectively shifting part of the investment burden to government partners.

Influence on Workforce and Talent Strategy

Hiring remains one of the most significant expenses for growing companies, especially in tech, logistics, and healthcare sectors. Many state and local incentives directly reward companies for creating and retaining jobs in specific areas, often with extra support for hiring veterans, disadvantaged workers, or residents of economically distressed communities.

This alignment between public interest and private hiring goals creates an opportunity to scale more cost-effectively. HR teams that align hiring timelines and locations with available incentives can help maximize both financial return and talent acquisition.

Strategic Site Selection and Flexibility

Multi-state employers often have multiple options when choosing where to grow. Incentives can serve as a tiebreaker or even tip the scales completely. Some states offer incentives specifically to attract companies from out of state or to retain employers considering relocation.

Understanding the full range of programs available before committing to a site enables companies to negotiate more effectively and structure their operations for long-term advantage.

Key Incentive Programs to Know

Incentives in the U.S. range from broad federal programs to highly targeted state and municipal offerings. Each program has its own rules and requirements, but many of them fall into a few main categories. Multi-state employers can take advantage of these categories smartly and strategically.

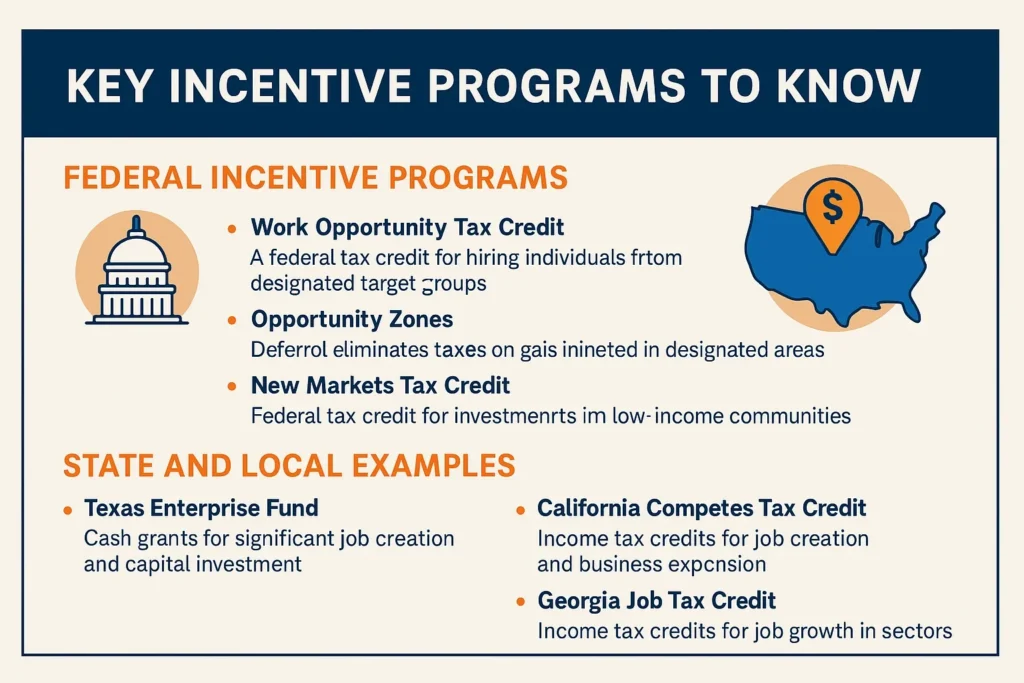

Federal Incentive Programs

While most Regional business incentives are administered at the state or local level, a few federal programs can influence where and how companies operate.

- Work Opportunity Tax Credit (WOTC): A federal tax incentive available to employers who hire individuals from certain target groups, including veterans, long-term unemployed workers, and recipients of public assistance. The credit can be worth up to $9,600 per qualified hire.

- Opportunity Zones: Established under the 2017 Tax Cuts and Jobs Act, these zones offer tax deferral or elimination on capital gains invested in designated low-income areas. Companies operating or investing in Qualified Opportunity Zones may benefit from long-term tax savings.

- New Markets Tax Credit: This program provides a federal Tax rebate for investments in low-income communities, encouraging economic development and job creation in underserved areas.

State and Local Examples

Each state maintains its incentive programs, often customized to support key industries or address regional workforce needs. Here are just a few high-impact examples:

- Texas Enterprise Fund (TEF): A cash grant program used to attract projects that offer significant job creation and capital investment. TEF is often awarded during competitive site selection processes.

- California Competes: A flexible income tax available to businesses that want to locate or stay in California and create quality, full-time jobs. Applications are evaluated based on job creation, investment amounts, and economic impact.

- Georgia Job Tax Credit: This program offers state income tax credits to businesses in strategic industries that create a minimum number of new jobs. The amount varies based on location, with rural and underdeveloped areas receiving higher incentives.

These programs represent only a fraction of what’s available. Many states offer additional credits for green energy use, research and development (R&D) investment, and manufacturing, among other incentives. Local governments may provide additional support through tax abatements, expedited permitting, or infrastructure improvements.

The key takeaway: These incentives are not uniform, and the value can differ significantly depending on where, when, and how your company operates.

Real-World Tech Example: AI Company Expansion

Artificial intelligence companies often face high infrastructure costs when scaling, from data center investments to hiring specialized talent. To attract such companies, several U.S. states have introduced targeted incentive programs designed to make large-scale expansion more financially viable.

In 2024, New Jersey launched the “Next New Jersey Program – AI,” a location-based incentive offering up to $500 million in tax incentives to companies investing in AI infrastructure and jobs within the state. To qualify, firms must commit at least $100 million in capital expenditures and create at least 100 full-time jobs in New Jersey.

As reported by New Jersey Monitor, the Fiscal credit equals the lesser of:

- 0.1% of total capital investment multiplied by the number of new jobs,

- 25% of the total eligible investment, or

- A cap of $250 million per project.

This initiative is designed to position New Jersey as a hub for AI and advanced computing while ensuring a clear return on investment for the state through job creation and long-term economic growth.

For multi-state tech employers evaluating expansion options, programs like this offer a direct incentive to localize investment and talent in areas with strong support infrastructure and government backing. It also demonstrates that maximizing business ROI isn’t just about tax benefits, but is part of broader state-level strategies to compete for high-growth industries.

Common Pitfalls Employers Face

While location-based incentives can offer meaningful financial benefits, many companies either leave value on the table or encounter compliance issues that negate the gains. These missteps are particularly common among businesses operating in multiple states, where incentive programs vary significantly in structure, eligibility, and enforcement.

Overlooking Eligibility Windows

Many incentive programs require early application, sometimes even before a lease is signed or construction begins. Companies that finalize a location or start hiring without consulting economic development agencies often disqualify themselves from valuable incentives and benefits. Timing is critical, and missing the pre-approval stage can result in the loss of millions of potential credits or grants.

Poor Alignment with Business Strategy

Some employers treat incentives as an afterthought, rather than integrating them into their site selection, hiring, or expansion planning. Without a strategic fit, companies may pursue incentives that deliver minimal ROI or are too complex to justify the administrative burden.

Compliance Failures

Once an incentive is awarded, ongoing compliance is essential. This includes maintaining job thresholds, submitting documentation, and hitting capital expenditure milestones. Missing reporting deadlines or failing to meet performance metrics can result in clawbacks or disqualification from future programs.

Underestimating Administrative Burden

Multi-state employers often juggle multiple program requirements across jurisdictions. Tracking eligibility, managing paperwork, and ensuring timely submissions across various departments (finance, HR, and legal) can strain internal resources, mainly when no centralized compliance process exists.

Leaving Incentives Unclaimed

Some companies never apply at all. Expansion and hiring often outpace incentive planning in fast-moving sectors like tech or healthcare. Many incentives go unnoticed and unclaimed, even when the company qualifies, because there is no dedicated team or external advisor.

Embedding Incentives into Growth Strategy

To fully realize the ROI potential of incentives, companies need to go beyond reactive claims and integrate these opportunities into their long-term planning. When approached strategically, incentives can influence everything from site selection and hiring timelines to capital budgeting and compliance processes.

During Site Selection and Expansion

The best time to evaluate incentives is before a location is chosen. Many state and local programs require pre-approval or early-stage coordination to qualify. This is especially true for discretionary grants or competitive tax offset programs.

Employers considering multiple regions should consider the availability of incentives and their potential dollar value alongside workforce availability, infrastructure, and logistics. By engaging with economic development agencies early and conducting cost-benefit analyses, companies can identify locations that offer not only operational advantages but also financial benefits.

When Scaling Workforce

Hiring and training are among the most commonly incentivized activities at the state and local levels. Programs may offer wage subsidies, Fiscal credit per new hire, or reimbursements for upskilling employees, especially when hiring from specific target groups, such as veterans, long-term unemployed individuals, or residents of economically distressed areas.

For HR teams, aligning hiring schedules and geographic focus with incentive eligibility can unlock significant savings. It also creates a clear business case for workforce development in high-potential markets.

When Relocating or Restructuring

Companies relocating part of their operations or consolidating facilities can also benefit from ROI-based incentives, particularly those tied to job retention, reinvestment, or infrastructure upgrades. Some states offer enhanced incentives to retain existing employers, making it worthwhile to evaluate opportunities even when downsizing or shifting focus between locations.

When to Consider External Incentive Support

Navigating location-based Tax offset across multiple states requires more than just general awareness; it demands careful coordination and a deep understanding of eligibility rules, application deadlines, and compliance processes at every level of government.

For organizations without a centralized tax or compliance team, handling these complexities in-house can stretch internal resources and increase the risk of missed opportunities or administrative errors.

Why Experience Matters

- Interpreting State-by-State Complexity: Each jurisdiction structures its incentives differently. There’s no standard template, from job creation thresholds to capital expenditure formulas. Specialists can help identify which programs a company qualifies for and which aren’t worth the time.

- Negotiating and Structuring Awards: Some incentives are discretionary or competitive. Economic development professionals know how to build the business case, model projected returns, and negotiate more favorable terms when possible.

- Managing Long-Term Compliance: Earning an Incentive Is Just the Beginning. Maintaining it requires documentation, employee tracking, and regular reporting. External support can make sure nothing slips through the cracks.

Companies navigating multi-state expansions can benefit from partnering with a specialist like Walton Management, which helps assess, negotiate, and track compliance for a wide range of location-based programs. Experienced professionals help align growth and hiring strategies with incentive programs, reducing risk and increasing ROI. Their knowledge of state-level policies, timelines, and compliance requirements can make a measurable difference.

Whether you’re expanding into a new market or scaling existing operations, working with experienced professionals can help organizations unlock potential benefits and avoid costly oversights.

Conclusion

For employers, location-based fiscal credits are no longer optional or obscure; they’re a proven strategy to improve ROI, reduce operational costs, and accelerate growth. Whether opening a new facility, scaling your workforce, or relocating part of your business, these programs can offer significant financial advantages if approached proactively.

As we’ve seen in sectors such as AI and healthcare, the companies that benefit most are those that plan ahead, align incentives with their strategic goals, and ensure ongoing compliance. The opportunity is real, but so are the complexities. Embedding incentives into your site selection, hiring, and investment decisions, whether managed internally or with external guidance, can unlock substantial long-term value for employers. In a competitive economic landscape, that edge matters.