Life insurance is a vital financial resource that offers peace of mind and guarantees financial security for you and your family. In Bethel, Alaska, selecting the right life insurance policy is particularly important due to unique regional factors and the specific needs of the community. This guide will help you navigate the process of choosing the right life insurance policy that fits your circumstances.

Choosing the right life insurance policy is crucial for ensuring your loved ones’ financial stability and security in your absence. The correct policy can cover essential expenses such as funeral costs, outstanding debts, and daily living expenses, providing peace of mind that your family will be taken care of.

Additionally, certain policies, like whole and universal life insurance, offer long-term benefits, including cash value accumulation that can be used for future financial needs. In Bethel, Alaska, the unique economic and geographic conditions necessitate careful consideration of policy types to ensure they align with local cost of living, healthcare access, and economic stability.

Understanding Life Insurance

Life insurance is a contract between a person and an insurance company where the insurer agrees to pay a designated beneficiary a sum of money upon the death of the insured person. This agreement provides financial protection and peace of mind, ensuring that loved ones are supported financially after the insured’s passing. Over 52% of Americans believe life insurance is too expensive, with many overestimating the actual costs by up to three times. Life insurance can also serve as a strategic financial tool for long-term planning and investment.

General Demographic Insights

- Gender Disparities: Life insurance ownership is lower among women (49%) compared to men (55%). This trend has continued for five consecutive years.

- Ethnic Variations: Hispanic Americans have the lowest life insurance ownership at 45%, while Black and Hispanic communities express a higher need for coverage.

- Generational Trends: Baby Boomers have the highest ownership rates, while younger generations, particularly Gen Z, show increasing interest in life insurance, with 44% of Gen Z and 50% of millennials intending to purchase policies in the near future.

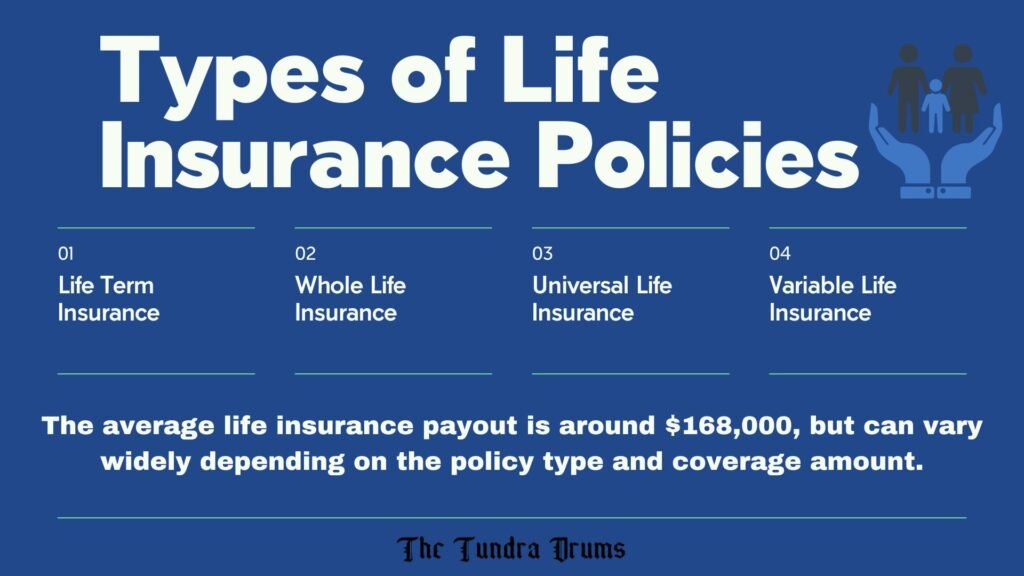

- The average life insurance payout is around $168,000, but can vary widely depending on the policy type and coverage amount. In 2022, total life insurance benefits and claims reached $797.7 billion.

Types of Life Insurance Policies

There are several types of life insurance; every policy is designed to meet different needs and financial goals. The most common types include:

1- Life Term Insurance: Life term insurance provides coverage for a short period of time, typically ranging from 10 to 30 years. It is straightforward and affordable, making it a popular choice for those seeking temporary coverage. If the insured person dies within the term, the beneficiary receives the death benefit.

Key Features:

- Fixed premium for the term duration.

- No cash value component.

- Generally lower premiums compared to permanent policies

2- Whole Life Insurance: Whole life insurance includes an investment component known as the cash value, which grows timely. This policy guarantees a death benefit and a cash value accumulation that policyholders can borrow against or withdraw during their lifetime.

Key Features:

- Lifetime coverage with fixed premiums.

- Cash value that grows tax-deferred.

- Higher premiums compared to term life insurance.

3- Universal Life Insurance: Universal life insurance provides flexible coverage with an adjustable premium and death benefit. It also includes a cash value component that earns interest based on current market rates. Policyholders can modify their coverage and premium payments to better suit their changing financial needs.

Key Features:

- Flexible premiums and death benefits.

- Cash value that earns interest.

- Potential for policy adjustments.

4- Variable Life Insurance: The policyholder can invest the cash value in various accounts, such as stocks, bonds, and mutual funds, offering the potential for higher returns.

Key Features:

- Investment options for cash value growth.

- Potential for higher returns and higher risk.

- Flexible premiums and death benefits.

Life Insurance Needs in Bethel- Unique Factors Affecting Bethel Residents

When choosing a life insurance policy in Bethel, Alaska, residents must consider several unique factors that can influence their needs and the type of policy that best suits their circumstances. These factors include geographic considerations, the local economy and employment landscape, as well as cultural and community aspects.

Geographic Considerations

Bethel’s remote location and harsh climate can significantly impact the cost of living and accessibility to services. The higher cost of goods and services due to transportation expenses can affect how much coverage is necessary to ensure sufficient financial support for loved ones. Additionally, the limited access to healthcare facilities may require policies that offer comprehensive coverage for medical and emergency expenses. Considering these geographic challenges, residents should look for policies that can accommodate higher living costs and potential medical needs.

Local Economy and Employment

The local economy in Bethel is heavily influenced by industries such as fishing, healthcare, education, and government services. Employment opportunities can be limited and seasonal, affecting residents’ income stability. This economic variability means that life insurance policies need to provide robust financial protection in the face of potential income fluctuations. Moreover, considering the possibility of irregular income, policies with flexible premium options, such as universal life insurance, may be particularly beneficial for Bethel residents.

Cultural and Community Aspects

Bethel’s community is characterized by strong cultural ties and a close-knit social structure. Many residents are part of extended families and place a high value on providing for their loved ones. This cultural emphasis on family support underscores the importance of having adequate life insurance coverage to ensure that family members are cared for in the event of the policyholder’s death. Furthermore, life insurance policies that offer benefits such as funeral expense coverage and support for dependents are particularly valuable in this context.

How to Choose the Right Policy in Bethel

Choosing the right life insurance policy in Bethel requires a thoughtful approach that considers the unique geographic, economic, and cultural factors of the region. Here are key steps to help you make an informed decision:

1. Assess Your Financial Needs

Start by evaluating your financial situation and the specific needs of your family. Consider factors such as:

- Income Replacement: Find out how much you would need to maintain the standard of living without your income.

- Debt and Expenses: Include outstanding debts, mortgage, loans, and everyday living expenses.

- Future Obligations: Consider future expenses such as college tuition for children or ongoing healthcare costs.

2. Understand the Different Types of Policies

Familiarize yourself with the various types of life insurance policies:

- Term Life Insurance: Ideal for those needing coverage for a specific period at an affordable cost.

- Whole Life Insurance: Suitable for those seeking lifelong coverage with a cash value component.

- Universal Life Insurance: Offers flexibility in premiums and death benefits, making it a good choice for those with fluctuating incomes.

- Variable Life Insurance: Best for those comfortable with investment risks and looking for potential higher returns.

3. Consider Geographic and Economic Factors

Bethel’s remote location and high living costs should be factored into your decision:

- Higher Coverage Amounts: Due to the higher cost of living and transportation expenses, you may need a higher coverage amount to ensure your family is adequately supported.

- Healthcare Coverage: Ensure your policy covers potential medical and emergency expenses, considering the limited access to healthcare facilities in Bethel.

4. Evaluate Insurance Providers

Research and compare different insurance providers to find one that offers policies suited to Bethel’s unique needs:

- Reputation and Stability: Choose a provider with a strong reputation and financial stability.

- Customer Service: Look for companies known for excellent customer service and claims processing.

- Policy Options: Ensure the provider offers a range of policy options that align with your specific requirements.

5. Review Policy Features

Examine the features available with each policy to customize your coverage:

- Accelerated Death Benefit: Provides access to a portion of the death benefit if diagnosed with a terminal illness.

- Waiver of Premium: Waives premiums if you become disabled and unable to work.

- Family Coverage: Consider riders that extend coverage to other family members.

6. Consult with a Financial Advisor

Seek advice from a financial advisor who understands the local context of Bethel. They can help you assess your needs, explain policy details, and guide you in choosing the most suitable policy.

7. Regularly Review and Update Your Policy

Life circumstances change, so it’s important to review and update your policy regularly to ensure it continues to meet your needs:

- Life Events: Adjust your coverage after major life events such as marriage, the birth of a child, or significant changes in income.

- Policy Performance: Monitor the performance of any cash value or investment components of your policy.

FAQs

What Factors Affect Life Insurance Premiums?

Age, health, gender, lifestyle, coverage amount, policy type, and occupation.

How Do I Know If I Have Enough Coverage?

Consider income replacement, debts, future financial goals, and daily living expenses. Aim for coverage 10-15 times your annual income.

Can I Change My Life Insurance Policy After Purchase?

Yes, you can adjust coverage, convert terms to permanent, add/remove riders, and change beneficiaries. Check with your provider for details.

What Happens If I Miss a Premium Payment?

Most policies have a 30-day grace period. If unpaid, the policy may lapse. Some allow reinstatement or use cash value for payment.

How Do I Make a Claim on My Life Insurance Policy?

Notify the insurer, provide a death certificate and claim form, submit documents, and follow up with the insurance company.