Disclaimer: This article is for informational purposes only and does not constitute financial or investment advice. Trading involves risk, and profits are not guaranteed. Always conduct your own research and consider your financial situation before making any investment decisions.

Modern copy trading is built on advanced trading technology that automates market participation. Research firm Gartner defines trading platforms as systems designed to perform financial market analysis and trade execution, emphasizing that technology and automation are central to modern trading ecosystems. This technological foundation enables features such as social and copy trading, where users can interact with markets in real time and automatically mirror the trades of experienced investors. Rather than relying on manual order placement, copy trading uses platform-level automation to replicate trades instantly, helping reduce execution delays and operational complexity for followers.

However, there’s one common and crucial question that lingers on many people’s minds: Is copy trading profitable in real-world conditions?

Exploring how copy trading works

Basically, copy trading is about linking investors’ trading accounts to those of selected traders. Whenever the chosen trader opens or closes a position, the same trades are automatically followed proportionally in the follower’s account.

The model mainly attracts those who struggle to get trading time or lack the skills or confidence to trade independently. But note that results differ based on the trader being copied, risk settings, and market conditions.

The potential benefits of copy trading

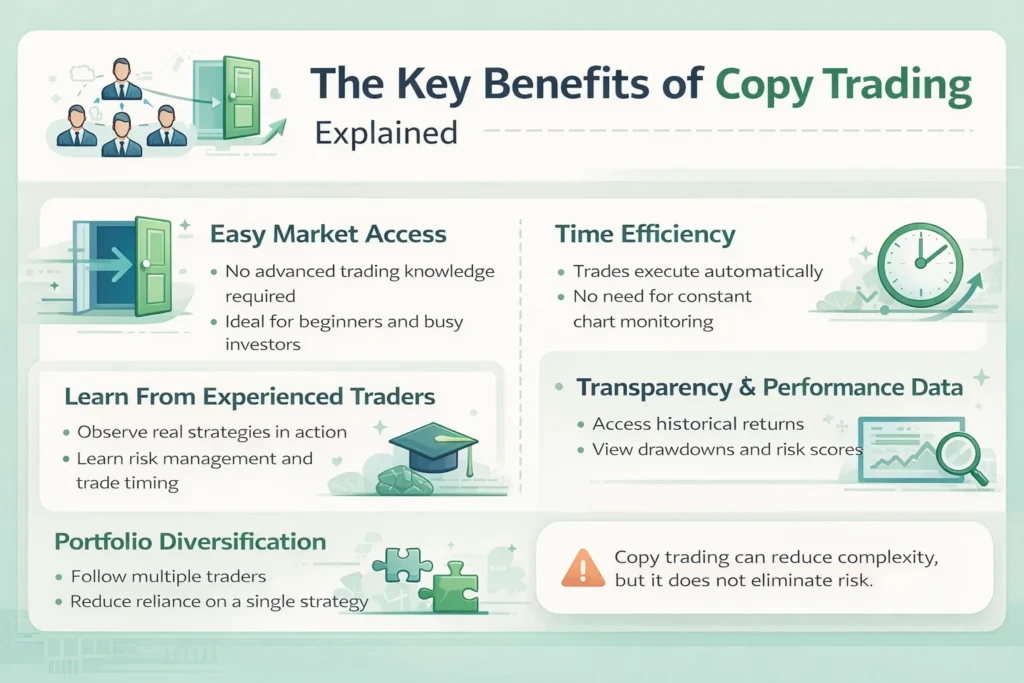

Here are a few possible advantages of copy trading:

- Accessibility: It helps new traders to participate in markets without advanced knowledge of strategy development or chart analysis.

- Transparency: Many trading platforms offer performance, risk, and drawdown history for the experienced traders whom investors are following.

Many interested investors often ask: Can you make money copy trading? The answer is yes, but your success depends on disciplined risk management and realistic expectations.

It is common to find good traders generating consistent returns. This can translate into steady copy-trade profits for followers who allocate funds wisely and diversify across several strategies.

Are you asking yourself, “Is copy trading profitable?” The truth is that you can reap profits, especially if you use reliable platforms. Such platforms offer structured copy-trading environments with performance indicators, enabling users to make better, more informed choices.

Key risks and limitations to weigh on

While it’s appealing, copy trading has risks. The risks include:

- No guaranteed future results: past performance does not guarantee future results, and even skilled trades go through losing periods.

- Various factors beyond the investor’s control can affect profits, such as market volatility, emotional decision-making by the lead trader, or sudden strategy changes that can influence returns.

When evaluating the risks of copy trading, it is crucial to recognize that it does not eliminate risk. One question often asked is: Will copy trading always be profitable?

The honest answer to this is a resounding NO. Losses are possible, especially if followers invest too much capital in a single trade or fail to adjust risk parameters.

Real-world results: a look at what traders experience

From a practical perspective, copy trading outcomes are mixed, and adoption patterns reflect this reality. In a review of major investment platforms, Forbes reported that around 11% of users have invested using social trading features, including copy trading, while an additional 9% engage with these tools in some capacity. This data suggests that copy trading is gaining traction among retail investors, but it is still used selectively rather than as a primary strategy by the majority.

Also Read: Investment Trends and Market Insights for 2026

This measured level of adoption aligns with real-world results: some investors achieve moderate, consistent growth, while others experience losses due to poor trader selection or unrealistic expectations. Over the long term, outcomes tend to favor investors who view copy trading as a learning tool and a way to diversify their portfolios, rather than a guaranteed source of income.

Conclusion

So, is copy trading right for you? The truth is, it can be profitable for some investors, especially those who take the time to research traders, monitor performance regularly, and manage risk. The option offers a practical entry point into trading while eliminating the need for constant market analysis.

Also Read: How Smart Trading Tools Can Help New Traders Avoid Costly Mistakes

One important thing to note is that copy trading should not be viewed as a guaranteed path to profits. As with any other investment, success depends on strategy selection, patience, and disciplined capital management. If investors approach it thoughtfully, copy trading can be a valuable addition to a broader investment approach and not just a shortcut to effortless gains.