| Investing in meme coins is highly risky. While there’s potential for quick gains, there’s also a high chance of substantial losses. |

Have you ever witnessed a meme coin spin and twirl through the crypto market like a carefree dancer? Once mere products of internet humor and trends, these tokens have transformed into severe financial players. Meme coins investment feels like a blindfolded ride on a roller coaster. Unlike traditional investments based on solid economic principles, meme coins ride the waves of viral memes and social media buzz. This inherent volatility poses significant risks for investors. While they promise quick profits, they lack conventional assets’ stability and intrinsic value, often crashing as dramatically as they rise.

Why is Investing in Meme Coins Very Risky?

1. Volatility Risk

2. Lack of Utility

3. Market Manipulation

4. Lack of Transparency

5. Emotional Investing

6. Regulatory Uncertainty

1. Volatility Risk

Meme coins are famous for their wild price swings. One moment, their value skyrockets, and the next, it plunges unexpectedly. What drives this roller-coaster ride? It’s not your typical market forces but trends on social media and celebrity endorsements. These factors are more significant in these crypto coins than solid investment principles.

Dogecoin, a popular meme coin, saw its price surge dramatically after social media endorsements but experienced sharp declines soon after. Following are the positive and negative aspects of its volatile nature:

| Positive Aspects | Negative Aspects |

| Potential for significant gains | There is a high risk of substantial losses |

| Opportunity for quick profits | Unpredictable market behavior |

2. Lack of Utility

The global cryptocurrency market capitalization has exceeded $2.5 trillion. However, unlike many traditional cryptocurrencies or assets, meme tokens often don’t have any actual use or practical value. Their worth mainly depends on how much people are interested in them, what’s trending online, and how much people are betting on them rather than anything they do. For example, the Shiba Inu coin gained popularity due to online memes but lacks real-world applications beyond speculative trading. So, investing in them is like putting your money on something just because of its popularity, not because it solves a real problem or has a solid plan. It’s like buying a collectible toy, it’s fun, but it won’t help you with anything practical like paying bills or buying groceries.

| Positive Aspects | Negative Aspects |

| Speculative investment opportunities | Lack of practical utility |

| Potential for community-driven value | Vulnerability to market sentiment shifts |

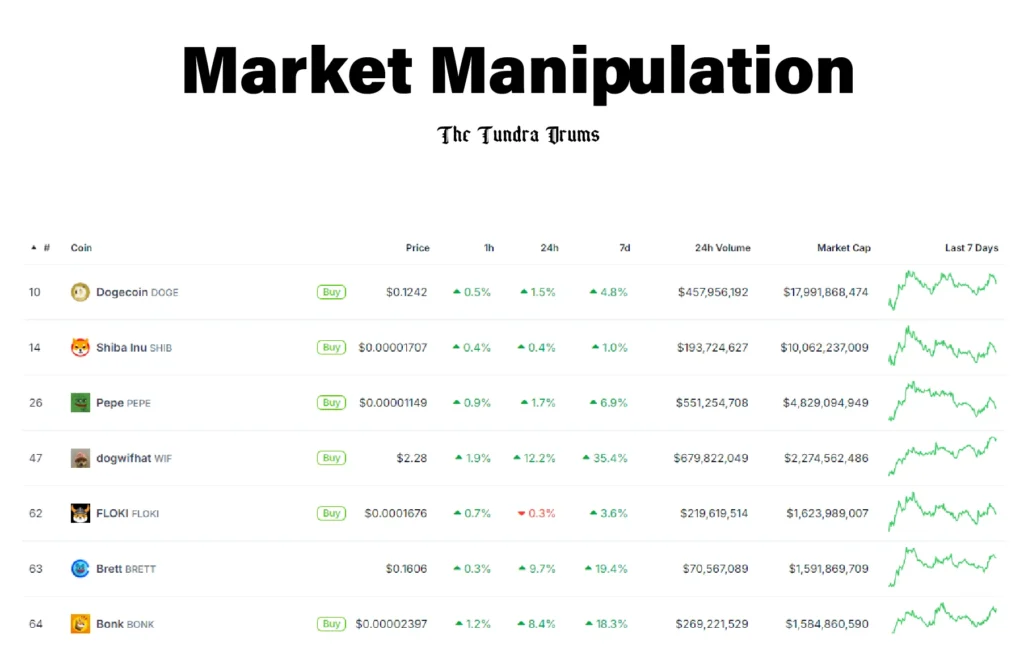

3. Market Manipulation

Meme tokens can be easily manipulated through schemes like ‘pump-and-dump.’ For example, a group of people gets together to inflate the price of a coin artificially. They hype it up, making it seem like everyone should buy in because it will skyrocket. But once enough people have bought in, and the price shoots up, they suddenly sell off their shares, causing the price to crash hard. This leaves regular investors, who didn’t know what was going on, with significant losses. It’s like someone blowing up a balloon to pop it when it’s complete, and you’re left holding the pieces.

| Positive Aspect | Negative Aspects |

| Awareness and regulatory scrutiny | Potential for fraudulent activities |

| Risk of significant financial losses |

4. Lack of Transparency

Many meme tokens operate in the shadows regarding who’s behind them, what they’re up to, and how they handle their money. It’s like trying to buy a car without knowing who made it, where it came from, or if it even runs! This lack of precise info makes determining whether these coins are legit or just a risky gamble challenging. It’s like walking into a dark room, and you can’t see what’s ahead, so you’re left guessing and hoping for the best.

| Positive Aspects | Negative Aspects |

| Potential for growth in transparency | Difficulty in determining project credibility |

| Opportunity for improved disclosure | Risk of investing in unreliable projects |

5. Emotional Investing

Investing in meme cryptocurrencies can stir up your feelings. Imagine seeing your favorite meme coin shoot up in value. It’s like winning a mini-lottery! But when it crashes, those emotions can turn from excitement to panic faster than you can say “sell.” That rush of emotion can make you act on impulse, which isn’t always a good thing in the unpredictable world of crypto. It’s like riding a wave. You feel the highs and lows intensely. Sometimes, those emotions can steer you into risky waters where losses can pile up quickly.

| Positive Aspects | Negative Aspects |

| Potential for quick returns | Risk of making emotionally driven decisions |

| Opportunity for learning discipline | Increased vulnerability to market shifts |

6. Regulatory Uncertainty

The rules around meme crypto are pretty dark. Governments and financial authorities are still figuring out how to handle these digital assets. This uncertainty can lead to sudden changes in laws or unexpected crackdowns, which can shake up the market and rattle investors. Meanwhile, Recent regulatory scrutiny of meme tokens in various countries has caused market turbulence and uncertainty.

Following are the positive and negative aspects of regulatory uncertainty in these cryptocurrencies.

| Positive Aspects | Negative Aspects |

| Potential for future regulatory clarity | Risk of adverse regulatory actions |

| Opportunity for market stabilization | Uncertainty impacting investor decisions |

How to Handle the Fluctuations of Meme Coins?

Understanding the world of meme coin investments requires careful consideration of these risks and a disciplined approach to mitigate potential losses. So, how can investors handle the ups and downs of meme tokens? Here are some practical tips:

| Aspect | Description |

| Stay Informed | Monitor market trends and news to understand what’s driving prices up or down. |

| Diversify Investments | Don’t put all your money into Meme cryptocurrencies. Spread your money across a variety of cryptocurrencies. |

| Conduct Research | Look beyond the hype. Understand the fundamentals of the meme token you’re investing in. |

| Be Mindful of Risks | These coins are high-risk investments. Thus, only invest what you are capable of losing. |

Conclusion

Investing in meme coins presents a tempting opportunity for quick profits, often fueled by viral trends and celebrity endorsements. However, the reality is starkly different. These digital assets are famous for their extreme volatility, which is capable of massive price swings that can lead to substantial losses. Also, these tokens are lack of utility and intrinsic value. Therefore, while these coins may offer brief excitement and potential gains, the overall landscape is fraught with uncertainty and possible financial losses. Investors should approach meme cryptocurrency investments with extreme care, fully understanding the high risks involved and being prepared for the possibility of significant downturns.