Disclaimer: This article is for informational and educational purposes only. It does not constitute financial, legal, or credit advice. Loan products, terms, interest rates, and eligibility requirements vary by lender and individual circumstances. Readers are encouraged to conduct their own research and consult qualified financial professionals before making any borrowing or financial decisions. The mention of specific services or platforms is for illustrative purposes only and does not imply endorsement.

Internet connectivity has become a key factor in accessing financial services, especially in the growing online lending sector. Borrowers increasingly rely on stable internet to explore loan products, submit applications, and receive decisions in real time, expanding access for those previously limited by geographic, economic, or institutional barriers. Globally, around 96% of the population now lives within reach of mobile internet coverage. Yet, more than three billion people remain offline, highlighting a digital divide that continues to limit access to online services, including digital lending.

Connectivity also affects information speed, the effectiveness of automated tools, and the reliability of account management, making consistent internet access central to both the borrower experience and lender operations. The following sections explore how connectivity shapes different aspects of online loan use.

Fiber-Optic Gateways to Finance

Reliable internet access expands individuals’ ability to engage with digital lending platforms by removing geographical and institutional barriers. This extended reach promotes financial inclusion, ensuring that more people can access credit options tailored to their circumstances. As a result, online lending ecosystems become more diversified, equitable, and responsive to varied socioeconomic needs.

Enhanced connectivity also supports continual user engagement with digital financial tools. This allows borrowers to manage loan applications, payments, and account inquiries efficiently. Continuous access also helps reduce the delays often associated with traditional banking systems, particularly where physical branches are limited. All of these enable borrowers to manage their finances more independently and with improved visibility.

Lightning Lanes of Lending

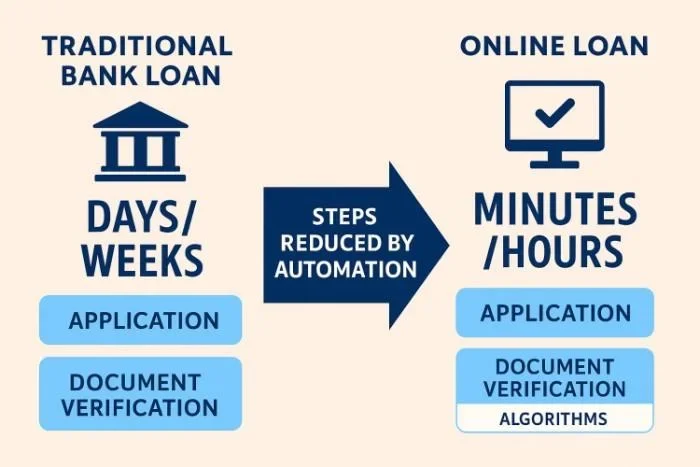

Rapid connectivity speeds up loan application processes by allowing platforms to transmit borrower information quickly and securely. This efficiency enables lenders to use automated verification systems, often powered by algorithms (step-by-step computational procedures) that assess eligibility in seconds. Consequently, lenders’ administrative burdens and borrowers’ waiting times are reduced, making digital loans appealing for individuals seeking streamlined, hassle-free borrowing experiences.

Websites like CreditNinja online loans allow borrowers to complete a straightforward application with basic information and receive loan amounts, rates, and terms tailored to their situation. Decisions are often made the same day, and once the agreement is finalized, funds can be deposited quickly. Flexible repayment schedules help borrowers manage their obligations, and all of these processes rely on having reliable internet connectivity.

Click-to-Know Clarity in Borrowing

Access to reliable internet allows borrowers to make informed decisions by providing them with extensive online resources. They can compare rates, repayment schedules, and lender reputations through financial comparison tools, ensuring transparency in their choices. Such access helps them gain financial literacy, reducing the risks associated with impulsive or uninformed digital loan uptake and predatory lending practices.

Aside from comparison tools, connectivity facilitates exposure to educational materials such as financial blogs, calculators, and expert analyses. These resources help borrowers understand complex concepts, such as the annual cost of borrowing or credit scoring methodologies. This informed perspective improves financial planning and fosters more sustainable borrowing behaviors within the online lending environment.

Pocket Power Payday Pathways

Increasing mobile internet usage has driven the widespread adoption of mobile lending applications that operate on smartphones and offer quick access to small, short-term loans. These platforms often use user-friendly interfaces and streamlined application processes, making them ideal for individuals without extensive financial experience. This shift enables greater convenience and fosters a culture of on-the-go borrowing that aligns with modern digital lifestyles.

Mobile-based loan systems frequently incorporate features such as instant notifications, repayment reminders, and digital receipts, all supported by stable connectivity. These features boost user engagement and support better financial management, especially for borrowers with limited access to traditional banking services. Through instant engagement with loan features, mobile systems reduce barriers that have traditionally limited financial access.

Also Read: How Small Businesses Can Benefit from Flexible Business Banking Solutions

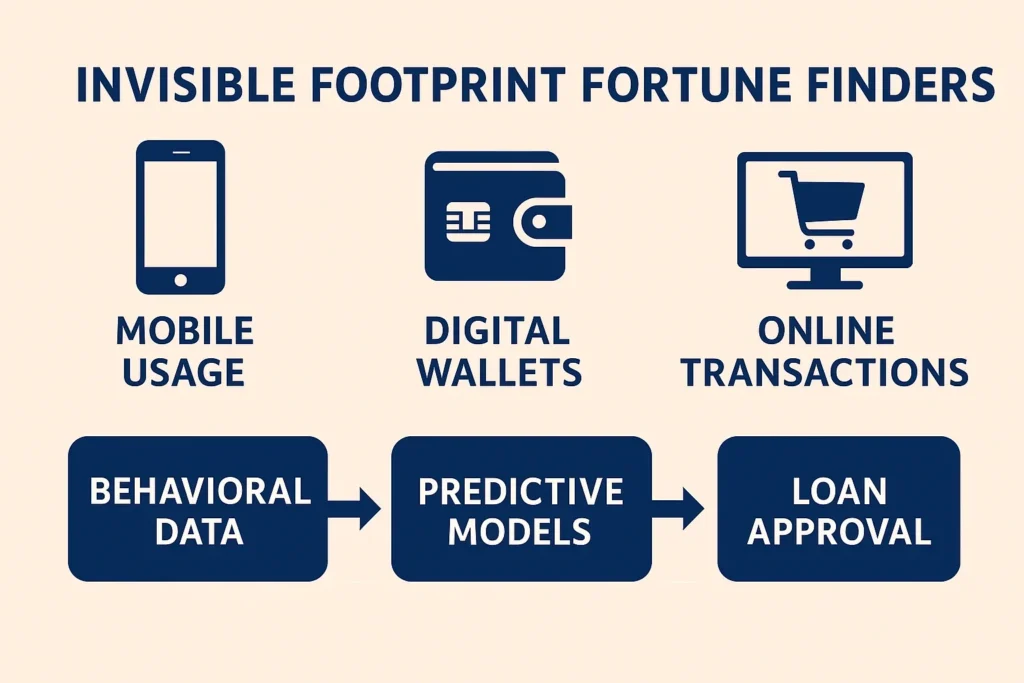

Invisible Footprint Fortune Finders

Digital lending platforms rely on alternative data sources, including nontraditional indicators of creditworthiness, such as mobile usage patterns, online purchase behavior, and payment histories within digital wallets. Consistent internet access makes these data points more reliable and plentiful, enabling lenders to use predictive models (mathematical tools that forecast outcomes) to evaluate borrower risk. This approach helps extend credit to individuals lacking conventional credit scores or banking records.

A robust digital footprint also enhances personalization in lending decisions, allowing algorithms to tailor loan terms, rates, and repayment schedules to individual behaviors. Such customization increases the likelihood of successful loan repayment and improves borrower satisfaction. For previously underserved populations, consistent connectivity enables the creation of credible financial identities, ultimately supporting more equitable access to credit.

Future Frequencies of Finance

The role of internet connectivity in shaping online borrowing has become more crucial as digital lending continues to expand. Reliable access not only enables borrowers to reach financial services that were once out of their grasp but also supports faster applications, quicker decisions, and more transparent loan management. According to the World Bank Global Findex, over 76% of adults worldwide now have access to a bank or mobile money account, up from 51% in 2011, a shift largely driven by expanded internet and mobile connectivity. It also enhances the functionality of automated systems, broadens access to information, and supports flexible tools that accommodate different financial needs.

These advantages collectively strengthen the appeal and practicality of online lending platforms across diverse communities. As connectivity continues to advance, online lending is poised to become even faster, more accessible, and more personalized, further strengthening financial inclusion in the digital economy.