Do you know how startups turn their dreams into reality and achieve success? It all starts with a simple yet transformative process: the business plan. But how to make a business plan? To make a successful business plan you have to follow these steps. With its power to map out a startup’s path to success, this document is the key to making your entrepreneurial dreams a reality.

Business plans are not just for startups; they are versatile processes for well-established companies. A business plan can be a game-changer for startups, helping them secure funding and attract potential investors with a clear vision and strategy.

But even for established businesses, a business plan serves as a compass, ensuring they stay on course and remain focused on their long-term objectives. Whether you’re just starting or have been in the game for years, a well-crafted business plan is your roadmap to success.

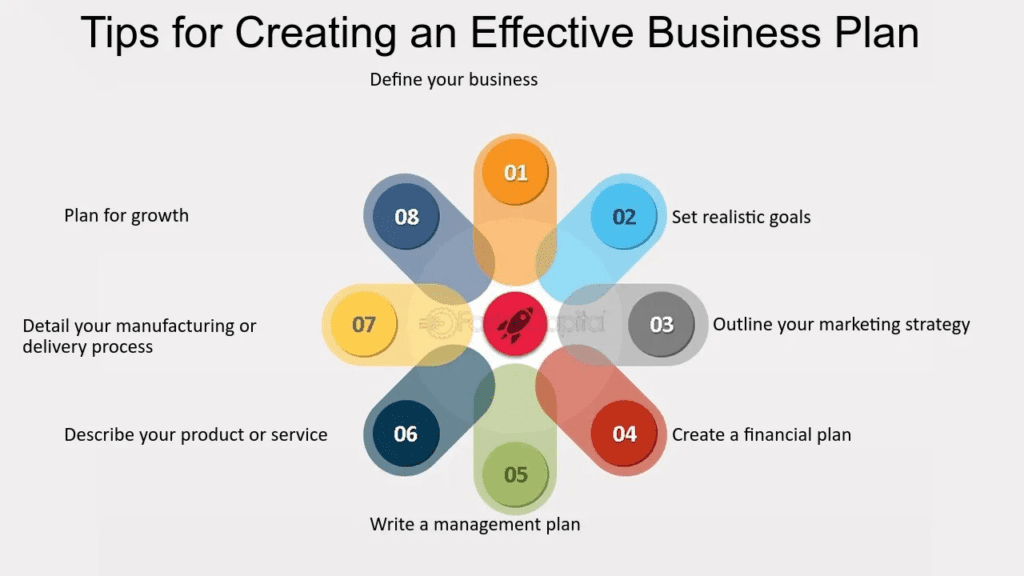

8 Essential Steps to Make a Business Plan

Each of the eight essential steps is like a signpost showing you how to start a business. These steps are necessary to get your startup off the ground, from explaining what your company is about to figuring out how much money you’ll need.

1- Market Research

Before getting into the business world, conducting thorough market research is crucial. This involves three key steps:

- Understanding your industry, identifying your target market, and analyzing your competitors. Firstly, understanding your industry means grasping the trends, challenges, and opportunities that shape it.

- Next, identifying your target market involves determining the specific group of people who are most likely to buy your product or service.

- Finally, analyzing your competitors helps you understand who else is vying for your customer’s attention and how you can stand out.

2- Defining Your Business Vision

It’s time to clarify your venture’s purpose, which starts with defining your business purpose. This involves crafting a mission statement that succinctly communicates what your company stands for and the value it aims to provide. Alongside this, setting long-term goals and objectives helps direct your journey, providing a roadmap for where you want your business to go and how you plan to get there.

3- Analyzing Your Competitors

Beginning with a thorough analysis of your competition is paramount when positioning your startup in the market or industry. By studying what other businesses are doing, you can identify gaps, opportunities, and areas where you can differentiate your offerings. This insight allows you to strategically develop your startup, focusing on unique selling points that set you apart.

Moreover, understanding the strengths and weaknesses of both your competitors and your own business is crucial. It enables you to capitalize on your strengths while mitigating weaknesses, ensuring your business is well-positioned to drive growth and succeed in the competitive market.

Let’s discuss the SWOT examination to kick off your competitive analysis: Strengths, Weaknesses, Opportunities, and Threats.

- Strengths: Identify what we excel in, such as marketing strategies, product quality, sales performance, branding efforts, and technological innovations.

- Weaknesses: Recognize areas where we struggle or face limitations, hindering our progress or competitiveness in the market.

- Opportunities: Explore potential growth areas, including untapped market segments, emerging trends, or changes within our industry.

- Threats: Assess external factors that pose challenges or risks to our business, such as intense competition, innovative advancements by competitors, or unaddressed consumer needs.

4- Financial Planning and Projections

This is all about crunching the numbers to understand your business’s financial health now and in the future. You’ll create forecasts and budgets to guide your financial decisions.

- Start-up Costs and Funding Requirements: Here, you’ll figure out how much money you need to get your business. This includes everything from equipment and inventory to salaries and rent. You’ll also outline where this funding will come from, whether from investors, loans, or personal savings.

- Profit and Loss Statements: Income statements show how much money your business makes (revenue), how much it spends (expenses), and, ultimately, how much profit or loss it generates. They’re crucial for understanding your business’s financial performance over time.

- Revenue Projections: This section predicts how much money your business will make over a certain period, typically one to five years. You’ll consider factors like pricing, sales volume, and market demand to develop these estimates.

5- Creating a Marketing Plan

A startup marketing plan is essential for driving business growth and requires careful strategic planning. It serves as a roadmap for reaching potential customers and outlines the methods through which marketing efforts will engage them.

Here are the key sections to include in your marketing plan:

- Business Objectives: These are the measurable goals your company aims to achieve within the next year, providing a clear direction for your marketing efforts.

- Marketing Priorities: Translate your business objectives into actionable priorities for your marketing team, outlining the specific tasks and initiatives they must focus on.

- Marketing Goals: Express these priorities as quantifiable statements that outline how your marketing activities will contribute to achieving your business’s broader objectives.

- Marketing Strategy: Combine your marketing goals and objectives into a cohesive plan outlining the approach and tactics you’ll use to achieve your business goals.

- Key Marketing Actions: Identify the specific actions your marketing team will take to execute the strategy, including campaigns, promotions, content creation, and advertising efforts.

- Dependencies and Risks: Define any factors or resources essential for your marketing strategy’s success and potential risks or challenges that may impact its effectiveness. By addressing these aspects in your marketing plan, you’ll be well-equipped to navigate the ever-changing landscape of startup marketing and drive meaningful growth for your business.

6- Creating an Organizational Structure

A clear organizational structure is crucial for defining the company’s roles, responsibilities, and reporting relationships. This structure provides a framework for decision-making, communication, and accountability.

Key Roles and Responsibilities: Define the essential roles for the business’s operation and growth. Clearly outline the responsibilities associated with each role, including tasks, goals, and performance expectations.

Building a Leadership Team: Identify individuals with the skills, experience, and leadership qualities needed to drive the business’s success. Build a leadership team of individuals who can effectively lead and inspire others, make strategic decisions, and navigate challenges.

Hiring and Staffing Plan: Develop a plan for hiring and staffing the organization to support its goals and objectives. Determine the staffing needs based on the company’s growth projections, budget, and operational requirements. Define the recruitment process, including sourcing, interviewing, and onboarding procedures, to attract and retain top talent.

7- Plan According To The Budget

Planning according to your budget is crucial as you develop your business operations plan. This plan is your blueprint for serving customers, managing costs, and ensuring profitability. It should outline strategies for everything from staffing to manufacturing to customer service.

As you dive into this planning process, you’ll need to answer key questions like:

- What facilities, equipment, and supplies are essential for your operations?

- How will your organizational structure be set up, and what are each employee’s responsibilities?

- Do you require research and development efforts, and how will you accomplish them?

- What are your initial staffing needs, and how will you expand your team as the business grows?

- How will you establish and manage business relationships, and how will they impact day-to-day operations?

- What operational changes might occur as the company grows or faces challenges?

8- Create a Contingency Plan

A contingency plan is vital to preparing your business for unforeseen circumstances and mitigating potential risks. This plan outlines steps to respond to unexpected events disrupting normal operations, such as natural disasters, economic downturns, or supply chain disruptions.

Key components of a contingency plan include identifying potential risks, assessing their possible impact on the business, and developing strategies to minimize disruption and ensure continuity of operations. This may involve establishing backup systems, securing alternative suppliers, cross-training employees, or securing additional financial resources.

What Must An Entrepreneur Do After Creating A Business Plan?

After creating a business plan, an entrepreneur must take several key steps to bring their vision to life:

- Implement the Plan: Implement the strategies outlined in the business plan. This may involve launching products or services, executing marketing campaigns, hiring team members, or establishing operational processes.

- Monitor Progress: Regularly review and assess how well the business performs against the goals and objectives outlined in the plan. Adjust strategies to stay on track and respond to market or business environment changes.

- Seek Funding (if needed): If the business plan identifies the need for external funding, such as loans or investments, the entrepreneur should seek financing from appropriate sources.

- Build Relationships: Cultivate relationships with customers, suppliers, partners, and other stakeholders to support the business’s growth and success.

- Stay Flexible: Be prepared to adapt and pivot as necessary based on feedback, market trends, and unforeseen challenges. Flexibility and agility are key qualities for successful entrepreneurs.

- Communicate the Plan: Ensure that all stakeholders, including employees, investors, and advisors, know the business plan and understand their roles in its execution.

- Measure Results: Continuously track and measure key performance indicators (KPIs) to gauge business strategies’ effectiveness and identify improvement areas.

How To Make a Financial Plan For a Business

Creating a financial plan for a business involves several key steps:

- Set Financial Goals: Determine the financial objectives you want to achieve, such as increasing revenue, reducing expenses, or achieving a specific level of profitability.

- Gather Financial Information: Collect and analyze relevant financial data, including past financial statements, sales forecasts, and expense reports.

- Create a Budget: Develop a budget that outlines projected income and expenses for the coming months or years. Allocate funds to various categories, such as operating expenses, marketing, and capital investments.

- Forecast Cash Flow: Estimate the timing and amount of cash coming into and out of the business to ensure you have enough liquidity to cover expenses and obligations.

- Identify Funding Needs: Determine if additional funding is required to support business operations or expansion plans. Explore funding options such as loans, investments, or grants.

- Monitor and Review: Regularly review your financial performance against your goals and adjust your plan as needed. Track key financial metrics to gauge progress and identify areas for improvement.

The Bottom Line

Creating a financial plan for your business is essential for setting clear goals, managing resources effectively, and ensuring long-term success. Regularly review and adjust your financial plan to adapt to changing market conditions and keep your business on track toward achieving its economic goals. With a solid financial plan, you’ll have the confidence and clarity to navigate the complexities of business ownership and build a thriving enterprise.