Disclaimer: This article provides general financial information based on publicly available resources and Alaska-specific guidelines. It is not tax, investment, or legal advice. For decisions that may affect your finances, please consult a licensed financial professional or tax advisor.

Managing money is tough enough on its own, and Alaska’s financial landscape adds its own layer of complexity. Sure, living in the Last Frontier comes with perks, but it also comes with higher everyday costs. For example, recent data shows Alaska’s residential electricity price at 27.71¢ per kWh, compared to the U.S. average of 17.62¢ per kWh, a vast difference you feel every month.

Even with these advantages, you still need to be intentional about where your money goes. High energy costs, healthcare challenges, and unpredictable expenses can catch you off guard if you’re not prepared. Understanding how Alaska’s financial system works can help you avoid unnecessary costs and make smarter choices with your income.

Here’s how you can make your dollars work harder in Alaska and build long-term stability in a state that rewards those who plan ahead.

Tip 1: Don’t Sleep on Your PFD

The Permanent Fund Dividend (PFD) is basically Alaska’s way of saying “thanks for living here.” Every year, you get a check from oil revenues, and this can be a significant amount. Some years it has been over $2,000 per person.

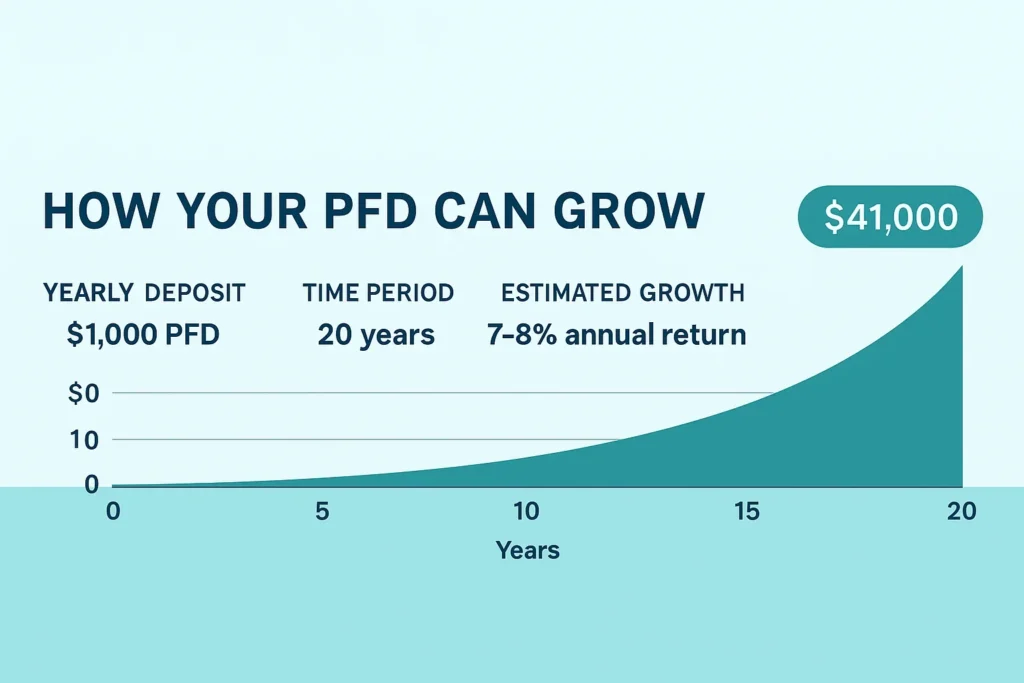

Most people make a mistake by blowing it on stuff they do not need. The PFD hits your account, and suddenly you are thinking about a new TV or a vacation. But what if you stuck that money straight into a Roth IRA instead?

Do the math. Even $1,000 invested annually for 20 years can result in serious money down the road.

Tip 2: Property Taxes Are Not One-Size-Fits-All

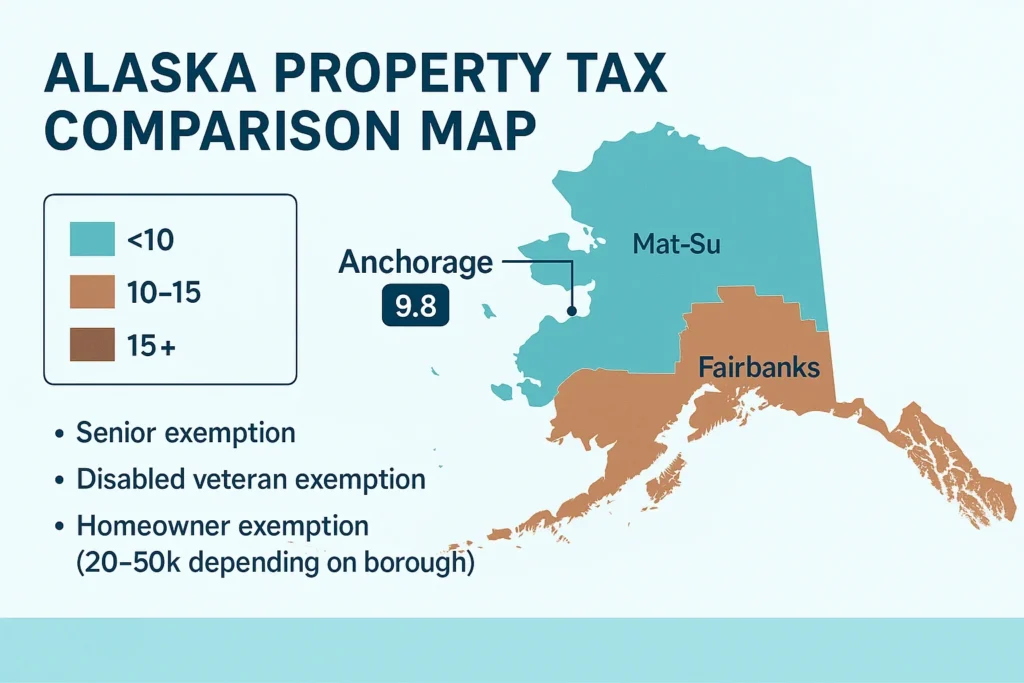

This one confuses people all the time. Alaska does not have state property taxes, but your borough or city does, and the rates can vary wildly depending on where you live. According to the Alaska Department of Commerce, only 15 of the state’s 19 boroughs levy a property tax, and just 9 cities outside those boroughs do the same. That means only 24 municipalities in the entire state collect property taxes, which is why the burden depends so heavily on your local government. Anchorage, for example, usually has higher mill rates compared to Mat-Su or smaller rural communities, while places like the North Slope Borough may charge more because they offer a wider range of services.

Also Read: Cost of Living in Anchorage Alaska | A Deep Analysis

Another thing most newcomers miss is exemptions. Many areas offer reductions if you are a senior, a disabled veteran, or if the property is your primary residence. In some boroughs, a homeowner exemption alone can knock $20,000 to $50,000 off your assessed value, lowering your annual bill significantly.

Also remember:

Local services affect taxes. If your borough handles schools, roads, emergency services, or utilities, your rates may be higher than in a community where residents rely more on state or tribal services.

Before buying a home, check:

- The current mill rate for that borough or city

- Whether the property is inside a special service area (which may add extra fees)

- What exemptions do you qualify for

- Any upcoming ballot measures that may raise taxes

Call your local assessor’s office and ask questions. It might feel boring, but finding out whether your annual bill will be $1,800 or $4,60 can literally save you thousands and prevent a massive surprise later.

Tip 3: Energy Bills Will Eat You Alive (If You Let Them)

Alaska’s energy costs are brutal, some of the highest in the nation. Your heating bill alone can be staggering.

Investing in efficiency upgrades works. New windows, better insulation, energy-efficient kitchen appliances, whatever it takes. It costs money up front, but you will make it back with lower bills.

Plus, there are rebate programs that will help cover the costs. The state actually wants you to use less energy, so take advantage of that.

Tip 4: Federal Taxes Still Matter

Just because Alaska does not want your income tax money does not mean Uncle Sam feels the same way. You are still fully responsible for federal income taxes, and those rules don’t become any simpler just because you live in the Last Frontier.

What catches many people off guard is that federal tax laws change constantly. Credits, deductions, energy rebates, child benefits, and retirement contribution limits shift year to year. Something that saved you money last April might not even exist this year.

Living in Alaska adds a few unique twists, too. If you work seasonally, live off-grid, rely on subsistence hunting, or collect the PFD, your tax situation might look a little different from someone living in the Lower 48. Even simple things like remote work income or per-diem reimbursements can get tricky.

That’s why, if you’re handling anything more complicated than a basic W-2, hiring a local Certified Public Accountant (CPA) is worth every penny. A good CPA will understand Alaska-specific scenarios, federal rule changes, and how to legally reduce your tax burden without missing something important.

Think of it this way: a one-time consultation can save you from years of headaches and potentially thousands in mistakes.

Tip 5: Healthcare Costs Are No Joke Up Here

Healthcare in Alaska is expensive; there’s no way around it. When you live in a state where doctors, specialists, and even basic medical supplies often have to be flown in, the price tags go up fast. Routine procedures that might be affordable in the Lower 48 can cost significantly more here. If you live in a remote community, travel expenses for medical care can add another layer of stress.

Also Read: Addressing Healthcare Issues in Bethel, Alaska: Insights from Local Providers

This is where Health Savings Accounts (HSAs) become your best friend. If you’re eligible, an HSA gives you a triple tax advantage: your contributions are tax-deductible, your savings grow tax-free, and anything you withdraw for qualified medical expenses is also tax-free. In a state with high healthcare costs, that tax relief makes a real difference especially if you’re planning for emergencies, surgeries, or chronic conditions.

Another mistake many Alaskans make is not comparing insurance options. Do not just take the first plan you see. Alaska has limited provider networks, and some plans barely cover certain regions or specialists. Two plans with similar monthly premiums can have completely different deductibles, co-pays, travel coverage, and out-of-pocket maximums.

If you live in a rural area, check whether the plan includes:

- Medical travel benefits

- Telehealth options

- Specialist access in Anchorage or Fairbanks

- Coverage for emergency flights

These small details can be the difference between a manageable bill and a financial nightmare.

The bottom line: in Alaska, healthcare planning is not optional. A wise insurance choice and a well-funded HSA can protect you from massive, unexpected costs.

The Bottom Line

Living in Alaska means playing by a different set of financial rules. The cost of living is higher, the environment is harsher, and the logistics behind everything from groceries to healthcare can surprise newcomers. But once you understand how the system works, you can actually come out ahead. No state income tax, no state sales tax, that annual PFD check, and smart decisions around energy, insurance, and savings can put you in a much stronger financial position than you might expect.

The key is to start with just one move. Maybe you set up automatic investing for your next PFD instead of spending it. Perhaps you finally call your utility company to ask about those energy rebates you keep hearing about. Maybe you can compare insurance plans to see if you can shave hundreds off your annual healthcare costs. In Alaska, even minor adjustments can snowball into meaningful long-term savings.

The Last Frontier doesn’t have to mean last place financially. When you take advantage of the benefits available here and stay proactive about the challenges, Alaska becomes more than just beautiful; it becomes a place where your money can actually grow. With the right strategies, living here isn’t just an adventure; it’s an opportunity.