Disclaimer: This article is for informational purposes only and does not constitute financial, career, or professional advice. Readers should consult a qualified advisor for guidance tailored to their individual circumstances.

Ever picture someone in finance and imagine a guy yelling into a phone while stock tickers race behind him? Or maybe it’s someone behind a desk, analyzing numbers with deadpan focus like a thriller plot. For most professionals, neither version hits the mark. In this blog, we will share what work in finance looks like and why the boring parts are more important than they seem.

It’s Not All Stocks and Suits

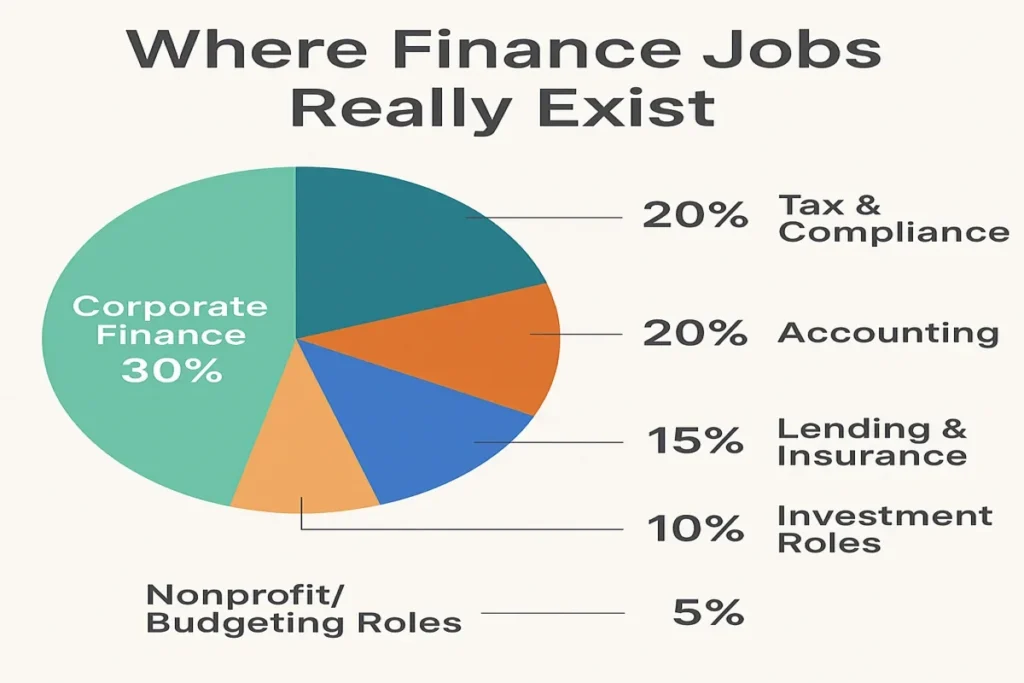

Finance covers more ground than most people realize. It isn’t confined to stock tickers or merger headlines. Most real work happens behind closed doors, far from trading floors. People build entire careers in areas like insurance, lending, payroll, budgeting, compliance, and tax strategy, many without ever brushing up against Wall Street.

How similar the work can look on the surface often throws people off. Spreadsheets and reports are everywhere, but the substance behind them varies wildly. One person might monitor cost controls for a logistics company, while another might build long-range forecasts for a nonprofit. The skills overlap, but the pace, pressure, and purpose are rarely the same. Some roles reward deep specialization, while others lean on broad problem-solving across departments.

Recent shifts in the workforce have only widened the scope. Remote tools, automation, and rising regulation have blurred the edges between finance, IT, and analytics. Job descriptions now mention software fluency alongside audit cycles. There’s a premium on people who can adapt fast, communicate clearly, and fix systems without breaking the rest of the flow.

Access to the field has expanded, too. You no longer need to live near a financial hub or chase a traditional path to move up. Pursuing something like a masters in taxation online opens doors to corporate finance, estate strategy, or regulatory review roles without pausing your career. It’s not just a workaround; it’s part of how the profession evolves to meet new challenges and expectations.

Finance isn’t a single lane. It’s a system of moving parts that hold businesses together. Most days don’t feel high-stakes, but everything slows down without that structure.

What You Do Most Days

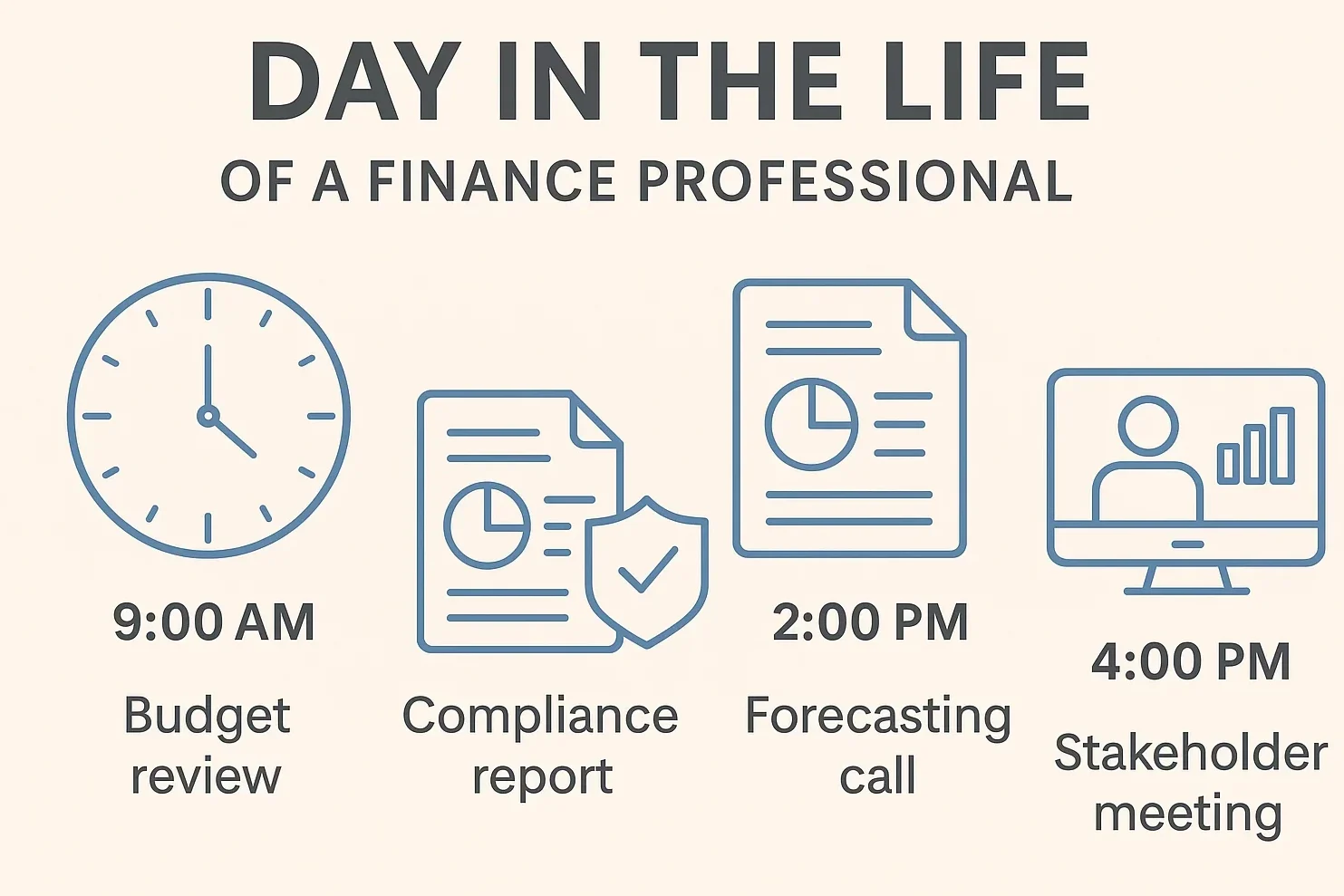

One of the most misunderstood parts of financial work is how much time is spent on routine. There’s a rhythm to most roles: closing books at month-end, preparing for audits, reviewing budgets, checking compliance, or running forecasts. None of it is flashy. But it’s essential. If you’re doing it right, the best days are when nothing unexpected happens.

If you’re in accounting, you’re reconciling ledgers, reviewing expenses, matching invoices, and prepping reports. In corporate finance, you’re building financial models, interpreting performance metrics, managing liquidity, and answering to stakeholders. In tax, your job may revolve around planning strategies that lower liability without crossing legal boundaries. In investment roles, you might spend the day gathering market intelligence, stress-testing assumptions, and keeping clients calm when volatility spikes.

Across the board, most people aren’t just pushing numbers; they’re connecting dots. When a manager overspends, someone flags it. When a project needs funding, someone evaluates the feasibility. When inflation messes with forecasting, someone has to rework the assumptions. Your value often comes from noticing patterns before they become problems.

It’s also a job where precision matters. Mistakes don’t always show up immediately, but when they do, they can trigger audits, penalties, or broken trust. A misclassified expense might seem small until it shows up in quarterly filings. A poorly communicated tax change could affect hundreds of employees. The day-to-day is often about doing small things well and understanding their larger impact.

Why People Stay (Or Burn Out)

The appeal of finance, at least on paper, is stability. The roles pay well, the work is predictable, and every organization needs it. However, the same factors that make it attractive can also wear people down if they’re not clear on what kind of stress they’re built for.

| Aspect | What to Expect | Ideal for People Who… | Warning Signs / Burnout Risks |

|---|---|---|---|

| Stability & Pay | Steady income, essential roles across industries | Value security, like defined career paths | May ignore job fit for prestige or money |

| Deadline-Heavy Roles | Closing cycles, audits, and tax season with immovable timelines | Work well under pressure, enjoy time-boxed goals | Struggle with time stress or lack of flexibility |

| Collaborative Roles | Frequent coordination across departments | Enjoy teamwork and cross-functional problem-solving | Feel drained by constant communication or meetings |

| Client-Facing Roles | Interacting with clients, answering diverse (and sometimes difficult) questions | Are patient, communicative, and calm under pressure | Dislike interruptions or emotional labor |

| Repetitive Tasks | Weekly/monthly cycles, regular reporting | Find comfort in routine and structure | Get bored or disengaged by repetition |

| Process-Oriented Work | Spotting inefficiencies, organizing data, and improving workflows | Like problem-solving and creating order from chaos | Feel unfulfilled if there’s little innovation or autonomy |

| Motivation Alignment | Roles aligned with interests, values, and mental rhythm | Are intrinsically motivated, enjoy the core work | Chose job for status/money; misaligned with real work and culture |

Some roles are deadline-heavy. Closing cycles, reporting windows, and tax season don’t move. If you need flexibility or hate working under pressure, that might be an issue. Other roles are deeply collaborative, requiring constant coordination across departments. If you prefer working solo, these positions might feel draining. There are even jobs where much of the work is client-facing, especially in advisory or wealth management. That means fielding questions that range from reasonable to ridiculous and staying calm through them all.

People who thrive finance usually like the process. They enjoy building order out of chaos, spotting gaps, reducing waste, or translating complexity into something usable. They also don’t mind repetition. If a task needs to be done every week, they don’t see that as boring; they see it as part of keeping the wheels turning.

Burnout happens when people choose roles based on prestige rather than preference. If you’re in it only for the money or the title, the long hours and constant pressure start to feel heavier. But if the rhythm fits your mind and you’re solving problems that feel meaningful, the work becomes sustainable, even energizing.

The Tools You Need Go Beyond Math

Many people assume finance is about being “good with numbers.” And yes, numbers matter. But once you’re in the field, you realize most problems aren’t math problems. They’re people’s problems. Someone didn’t follow the budget. Someone misunderstood the policy. Someone took a shortcut that created a compliance issue. Someone doesn’t want to hear that their request isn’t financially feasible.

| Tool / Skill | Purpose / Role in Finance |

|---|---|

| Communication Skills | Explaining data clearly, managing expectations, and resolving conflicts |

| Tech Literacy | Navigating platforms like SAP, Oracle, QuickBooks, Tableau, and Workday |

| Analytical Tools | Using spreadsheets, financial models, and analytics software |

| Certifications / Courses | Enhancing skills in data analytics, financial modeling, or compliance |

| Professional Judgment | Spotting issues, knowing when to escalate, and interpreting data beyond the surface. |

That’s why communication is key. You’re not just crunching data, you’re explaining it to people who don’t understand it. You’re managing expectations, diffusing tension, and guiding decision-making. In fact, many finance professionals emphasize that soft skills are just as critical as technical expertise.

Tech literacy is also climbing the list. Spreadsheets are still foundational, but most finance teams now work in systems like SAP, Oracle, QuickBooks, Tableau, or Workday. Learning how to navigate those platforms or at least work alongside the people who do is no longer optional. And if you’re coming up in the field, certifications or extra coursework in data analytics or financial modeling can help you stand out.

That said, no tool replaces judgment. Being able to look at a report and say, “Something’s off,” or knowing when to raise a red flag still comes from paying attention, asking thoughtful questions, and learning through repetition.

The Day-to-Day Builds the Bigger Picture

Most careers in finance won’t give you a dramatic origin story. There’s no movie-worthy moment where you save the company from collapse by spotting a hidden formula error. But there is satisfaction in knowing your work keeps things from falling apart.

You’ll help projects stay funded. You’ll flag inefficiencies before they cost too much. You’ll give leadership the numbers they need to make informed calls. And over time, those contributions add to trust, which puts you in the room when real decisions are made.

So if you’re drawn to finance, don’t just chase the headlines. Look at the habits, the skills, and the small wins that happen daily. That’s what the job is really built on. And if you like bringing clarity to chaos, there’s a good chance you’ll find your fit. Professional career tips for finance professionals can help you grow with intention and stay aligned with what the work demands.