Disclaimer: The information provided in this article is for educational and informational purposes only and is not intended as financial, medical, or psychological advice. Always consult with a qualified financial advisor, licensed therapist, or healthcare professional regarding your specific situation. While every effort has been made to ensure the accuracy and reliability of the content, the author and publisher assume no responsibility for errors, omissions, or any consequences arising from the use of this information.

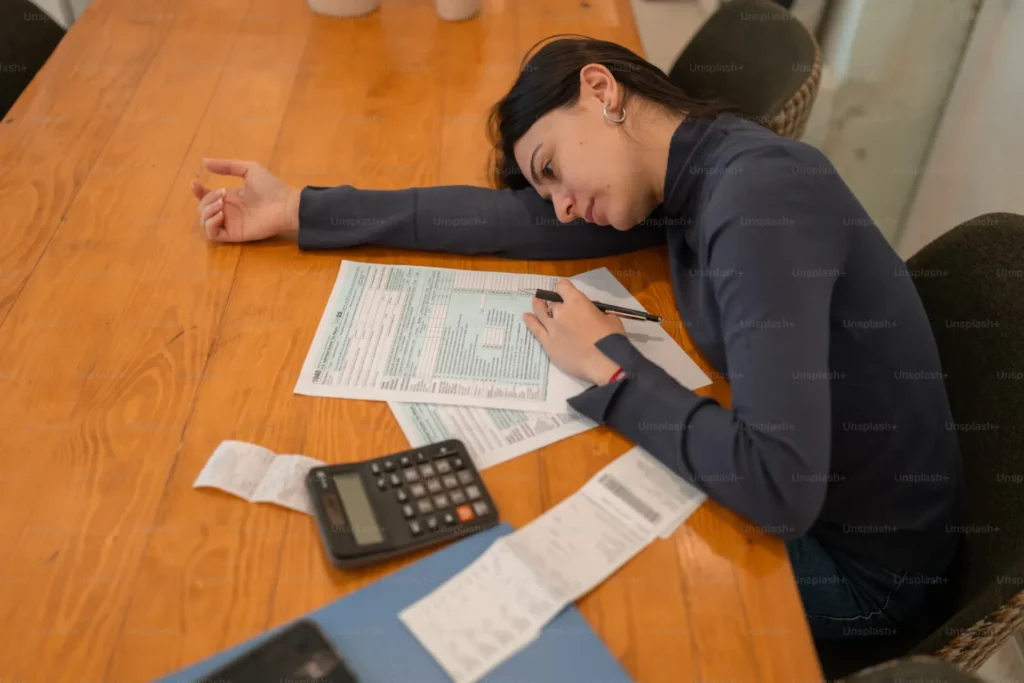

Debt is more than just a burden on your finances; it can have significant consequences on your mental health as well. Others struggling with debt often find themselves stuck in a loop of stress, anxiety, and depression. It’s not only about the numbers in your bank account; debt and Psychological health problems can literally impact your brain, which can set the stage for a lifetime of emotional and physical health issues.

If you’ve found yourself overwhelmed by credit card bills, loans, or other financial obligations, you’re not alone. Whether you’re considering debt consolidation to simplify your finances or just trying to make ends meet, it’s essential to understand how debt can shape your mental state. Let’s take a closer look at how debt affects your brain and overall well-being.

Debt and Its Impact on Mental Health

The link between debt and mental health is stronger than many people realize. Financial stress often leads to emotional health problems such as anxiety, depression, and even sleep disorders. The constant worry of not being able to pay bills or feeling like you’re never going to get out of debt can leave you feeling overwhelmed and helpless, negatively impacting your emotional health.

- Prolonged Stress: Debt often creates a state of chronic stress. When you’re constantly worried about how to pay off what you owe, it can activate your body’s stress response, releasing stress hormones like cortisol. Chronic stress from a loan can lead to exhaustion, irritability, and difficulties concentrating. Over time, this persistent stress can build up and make it harder to cope with daily challenges, leaving you feeling emotionally drained and hopeless.

- Anxiety: As debt piles up, so does the anxiety of not knowing how to deal with it. Any fear of the risk of the bills and collections, lawsuits, etc., can cause sleepless nights in fear. This increased anxiety can manifest in physical sensations like racing thoughts, difficulty breathing, and restlessness. It’s not hard to understand how the financial pressure of a loan can seep into your emotional life, reducing your capacity to relax or enjoy life.

- Depression: Debt can also raise the risk of depression. If you’re in a constant battle with bills, it may seem as though there’s no exit. Once a bubbly, bubbly person, debt weighs heavily on one over time until it becomes hopeless and desperate. You may start to feel like your situation is permanent, and that can sap your motivation and pleasure for activities you used to care about. For a lot of people, the sensation of digging a financial hole can rise to emotional paralysis.

How Debt Affects Your Physical Health

The mental strain caused by debt doesn’t just stop at emotional issues; it can also take a toll on your physical health. Stress, anxiety, and depression linked to financial struggles can have serious consequences on your body. This is because the mind and body are closely connected, and emotional distress often manifests physically.

- Sleep Issues: A lack of sleep often leads to financial stress. It’s tough to unwind when you’re fretting over debt, which can mean tossing and turning at night. Not getting enough sleep can lead to trouble concentrating during the day, higher levels of irritability, and even adverse effects on your immune system. Chronic sleep deprivation carries long-term health risks, which include heart disease, diabetes, and high blood pressure, over time.

- Increased Risk of Heart Disease: The stress that comes with Obligation can also affect your heart health. High levels of cortisol from chronic stress can contribute to inflammation in the body, leading to an increased risk of heart disease. Additionally, people who are constantly stressed about money may engage in unhealthy coping mechanisms, like smoking or overeating, which further increases the risk of developing cardiovascular problems.

- Digestive Problems: Stress from debt can also affect your digestive system. People who are under constant stress are more likely to experience stomach issues like ulcers, irritable bowel syndrome (IBS), and acid reflux. The stress hormones released when you’re worried about your finances can disrupt the normal functioning of your digestive system, leading to discomfort and long-term digestive issues.

The Stigma of Debt and Seeking Help

Among the reasons that debt is so harmful to mental and physical health is the social stigma around it. Some people ask something about money and expect an answer that makes them look like irresponsible, incompetent, or stupid. That isolation can increase depression and anxiety, creating a feedback loop: someone is struggling and feels more separated from their network, making them feel more disconnected from those support systems.

Fear that others will criticize them for having an Obligation can also stop people from discussing their difficulties with family or friends. Instead of seeking help, many people attempt to carry the weight alone, which only increases the emotional strain. The notion that debt is to be buried can contribute to people feeling increasingly isolated, increasing the risk of the issues. But whether it’s turning to a financial counselor, confiding in loved ones, or even exploring alternative options like debt consolidation, seeking help can ease the emotional weight of debt and positively impact mental well-being and health.

Practical Steps to Alleviate Debt-Related Stress

If you’re feeling overwhelmed by debt, it’s essential to take steps to regain control and reduce the stress it’s causing. Here are a few ways you can manage the emotional and physical effects of debt:

- Create a Budget: One of the first steps to taking control of your finances is to create a budget. A budget allows you to track your spending, identify areas where you can cut back, and make a clear plan for paying off your debt. Knowing that you have a plan in place can ease anxiety and help you regain a sense of control over your financial future.

- Consider Debt Consolidation: Debt consolidation could be a practical solution if your debt or emotional health feels unmanageable. Combining your debt into a single monthly payment reduces stress from managing several accounts. It can also lower interest rates, making your debt more straightforward to pay off sooner, alleviating some of the strain on your Loan and emotional health.

- Reach Out for Support: Don’t be afraid to ask for help. Whether it’s talking to a financial counselor, seeking professional support, or opening up to friends and family, it’s essential to have a support system in place. Talking about your Loan and emotional health struggles and the stress it causes can help reduce the emotional burden and make it feel less isolating. For some, incorporating alternative approaches to mental health, like running therapy, can also provide relief and complement traditional support systems.

- Practice Self-Care: Take care of your body and mind. Regular exercise, healthy eating, and getting enough sleep are essential for maintaining your overall well-being. Activities like yoga, meditation, or journaling can also help reduce stress and improve your mental clarity.

Final Thoughts: Regaining Control Over Debt-Related Stress

A loan can have a significant impact on both your emotional health and physical health. The stress, anxiety, and depression that often come with financial struggles can leave you feeling overwhelmed and helpless. However, by taking practical steps to manage your finances, seeking support, and addressing the stigma surrounding it, you can reduce the adverse effects it has on your brain and body.