Disclaimer: This article is for informational purposes only and does not constitute financial, legal, or tax advice. Always consult a qualified professional or financial advisor before making decisions related to your rental property or business banking. Regulations and requirements may vary by location and individual circumstances.

It gets confusing when your rent payments mix with daily expenses. You scroll through your account, trying to sort out which charge came from tenants and which went to groceries. It feels messy and time-consuming. Many landlords face the same problem when they use one account for everything. That’s why setting up a proper bank account for rental property becomes so essential.

In this blog, you’ll learn when you actually need a firm checking account, what the law says, and how tools like Baselane make rental income management easier. You’ll also see which account type works best for your setup, whether you own one property or several. Let’s make your finances cleaner and more organized.

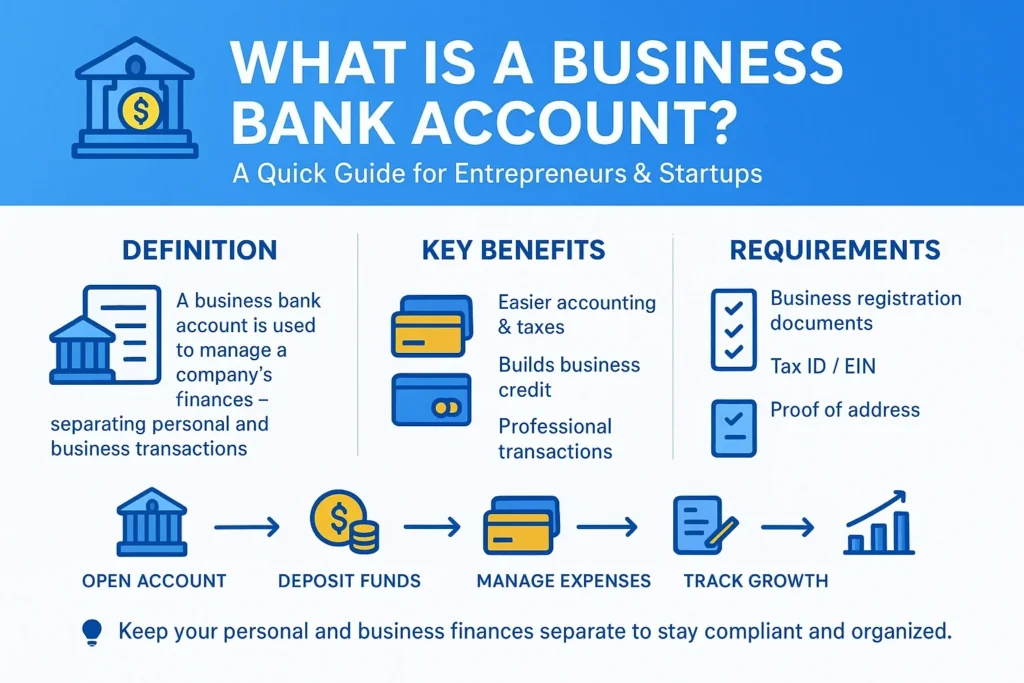

What Is a Business Bank Account?

A company checking account is a financial account explicitly created for business activities. It separates personal transactions from business income and expenses. For landlords, it helps manage rental payments, maintenance expenses, and property-related transfers clearly.

Having this account gives you a clear picture of your property’s performance. It simplifies reporting, tracks profit, and improves record-keeping for taxes.

Difference between Personal and Business Accounts

A personal Financial account manages daily spending, while a firm account handles income and costs from an operation. When you mix both, your bookkeeping becomes complicated. It’s harder to distinguish between rent income and personal money.

A business account provides transparency. You can show accurate income statements to lenders, accountants, or tax authorities without confusion.

| Feature | Personal Money Account | Business Financial Account |

| Purpose | Used for daily personal spending and income | Used to manage rental income, expenses, and property-related transactions |

| Record Keeping | Mixed transactions make tracking rental income difficult | Keeps financial records clean and separate for accounting and tax filing |

| Credibility | Not suitable for presenting business income to lenders | Builds professional credibility with banks and investors |

| Tax Reporting | It isn’t very easy when personal and rental expenses mix | Simplifies tax preparation and reduces reporting errors |

| Access & Features | Limited tools for business tracking | Offers expense categorization, reporting, and automation tools like Baselane |

| Compliance | No formal compliance requirements | Required for landlords operating as limited companies or LLCs |

Why Landlords Consider a Business Money Account

Landlords often open an enterprise account to manipulate more than one tenant, house, or bill successfully. It reduces accounting errors and makes audits simpler. When tax season comes, you already have organized statements ready. Tools like Baselane help automate tracking by linking directly with your bank, categorizing expenses, and generating rent reports in real time.

Legal Requirements for Rental Properties

There is no strict law requiring individual landlords to open a Financial account for rental property. However, if you operate through a limited company, then you must have one. It’s required for compliance and tax separation. Even for sole landlords, HMRC recommends using a separate account for rental income. It supports clean bookkeeping and protects you during tax assessments.

When You Need a Corporate Money Account

In case you own a couple of condo assets or operate under a limited liability company, a commercial enterprise business account is essential. It keeps your records transparent and supports professional management.

You also need one if you plan to grow your property portfolio or work with partners. Banks often request a dedicated account before approving buy-to-let financing.

When You Don’t Need a Company Banking Account

If you own one Leasehold property and receive rent casually, you might manage with a personal account. Many landlords do this to avoid fees or extra paperwork.

However, even in small setups, using a separate personal account for rent can help. It maintains order without the formality of business banking.

Pros of Using a Business Banking Account

A firm checking account simplifies financial management. It tracks rent inflows, expenses, and maintenance payments in one place.

It also builds credibility with banks and creditors. Over the years, it has let you qualify for business credit or investment loans. Some banks also offer landlord-focused tools for expense tracking and accounting. Over

- Keeps personal and rental finances separate and organized

- Simplifies bookkeeping and financial tracking

- Helps identify profit and loss for each property

- Supports accurate tax filing and easier audits

- Builds trust with tenants, lenders, and accountants

- Provides access to tools for rent collection and expense management

- Enables integration with platforms for automation and reporting

Best Types of Business Accounts for Landlords

The best Business account for a rental property depends on how you manage it. Digital platforms specialize in rental income tracking. They integrate with accounting equipment, automate transfers, and generate targeted reports. Conventional banks like Barclays or Lloyds offer solid business money management, but online systems often provide faster insights and greater automation for landlords managing multiple units.

Common Mistakes Landlords Make

Many landlords blend personal and condominium expenses in one account. This results in confusion, ignored deductions, and poor financial tracking.

Others rely most effectively on guide information or late updates. Using digital tools avoids this and keeps your data accurate on a daily basis.

Managing Rent Payments through a Company Account

A dedicated business account helps you handle incoming rent securely. Tenants pay directly into the account, reducing confusion and eliminating the need for bills.

You may additionally automate outgoing transfers like mortgage payments or upkeep prices. Baselane syncs these actions in real time, providing you with control over every transaction.

Using an LLC for Rental Properties

If your Leasehold property is under a limited company or LLC, having a Corporate bank account is essential. It’s legally required to separate company funds from personal money.

This setup also provides liability protection. Your personal assets remain safe if any legal or financial issue arises with the property.

Tax Benefits of a Corporate Bank Account

A company checking account makes tax reporting simple. You can easily calculate income, deductible expenses, and overall profit. It also speeds up self-assessment filing.

In addition, clear records help reduce errors and prevent penalties from HMRC. Many landlords use accounting software to sync these records automatically for tax season.

Tips for Managing Multiple Properties

Use one dedicated account for each property or group of rentals. It keeps things organized when scaling your portfolio.

Pick out virtual structures that permit integration with accounting software. Similar gear helps you view all transactions, lease schedules, and income reviews from one dashboard.

FAQs:

1. What makes ACH payments the easiest way to pay rent?

ACH payments let rent move directly from your Money account to your landlord’s account. It’s fast, secure, and eliminates manual payments or late fees.

2. How does Abode use ACH payments for rent?

Abode allows tenants to set up automatic ACH transfers for monthly rent. The system sends payments directly to landlords, saving time and reducing missed payments.

3. Are ACH payments through Abode safe?

Yes. ACH transfers on abode use bank-level encryption to protect your information. Every transaction is verified and processed through secure banking networks.

4. Can I schedule recurring rent payments with ACH on Abode?

Sure. You could set habitual bills so the lease is going out routinely on your preferred date. It keeps you constant and avoids last-minute stress.

5. Do ACH payments have fees on abode?

ACH payments usually have little to no fees compared to credit or debit cards. Abode’s platform helps tenants and landlords save on unnecessary processing costs.

Conclusion

Setting up a Corporate Money account for your Leasehold property is one of the easiest ways to simplify finances, build credibility, and stay tax-ready. Whether you manage one unit or a whole portfolio, separating business and personal funds keeps your records clean. Platforms like Baselane or your preferred digital banking tool make tracking, rent collection, and expense reporting effortless, helping you focus more on growth and less on confusion.