Disclaimer: This article is for educational purposes only and does not constitute financial advice. Always consult a licensed professional before making any trading or investment decisions.

The foreign exchange (forex) market is the largest financial market in the world, with trillions of dollars traded daily. For beginners, it may not seem very safe at first, but the basics are easier to understand than you might think.

One of the most common starting points for new traders is focusing on trading major forex pairs, which are the currencies most widely traded globally. These pairs represent the backbone of the currency market and are often considered the best entry point for those just beginning their trading journey.

Understanding Major Forex Pairs

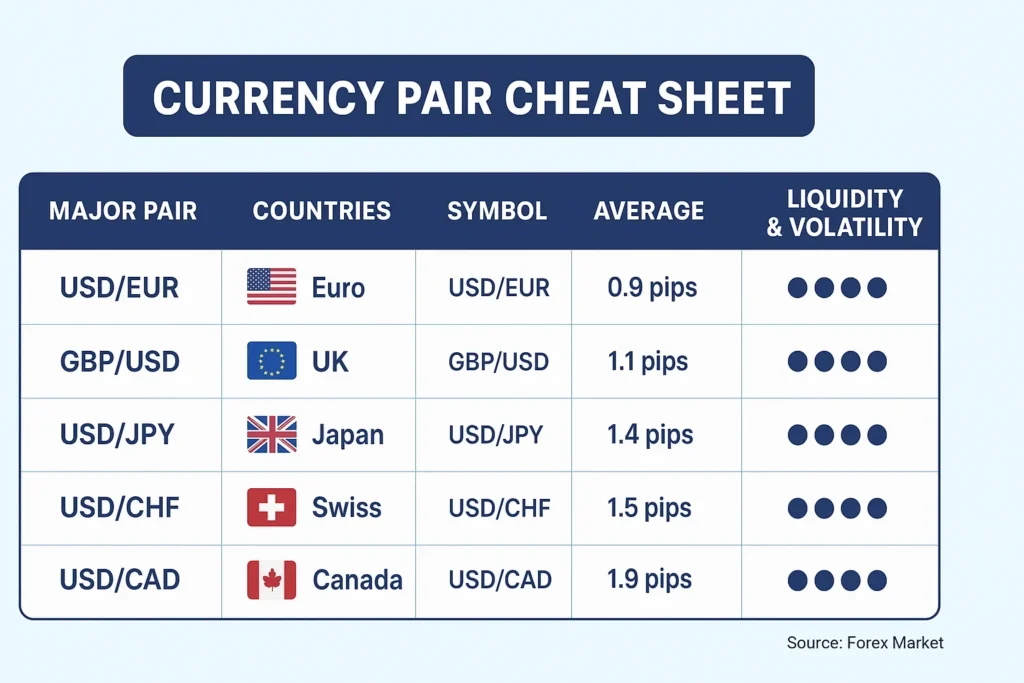

The U.S. dollar (USD) and another significant international currency are examples of major pairs. The euro (EUR), British pound (GBP), Japanese yen (JPY), Swiss franc (CHF), Canadian dollar (CAD), Australian dollar (AUD), and New Zealand dollar (NZD) are typically among them. Popular pairs include USD/JPY, EUR/USD, and GBP/USD.

These pairs are highly liquid due to their global significance, making it easier to buy and sell them without experiencing abrupt price swings. Beginners can avoid the erratic swings that are frequently present in minor or exotic currency pairs by trading more smoothly when liquidity is available.

Why Beginners Should Trade Major Pairs

Predictability and stability are crucial in the beginning. Major pairs are more affordable for novice traders because they typically have narrower spreads (the difference between the bid and ask prices). In contrast, the price movements of less well-known economies are also influenced by widely reported economic events, such as changes in interest rates or employment reports, which are easier to monitor and understand.

Put another way, major pairs provide a good starting point for individuals new to forex trading, as they strike a balance between opportunity and risk.

Key Factors That Move Currency Markets

To trade successfully, it’s essential to understand the factors that influence currency prices. Economic indicators such as GDP growth, inflation rates, and employment data play a significant role. Central bank policies, particularly interest rate adjustments, often prompt immediate reactions in currency values. For example, if the U.S. Federal Reserve raises rates, the U.S. dollar usually strengthens against other currencies.

Geopolitical events also affect markets. Political stability, trade agreements, or unexpected events can all cause volatility. Beginners should develop the habit of staying updated with financial news, as this helps them anticipate movements in major foreign exchange (forex) pairs.

Strategies for Trading Major Forex Pairs

There are many trading strategies, but beginners can start with a few simple ones. Trend following is a popular method that traders use to look for currencies moving consistently in one direction and ride that trend. Another strategy is range trading, where traders buy at support levels (price floors) and sell at resistance levels (price ceilings).

Risk management is equally important. Using stop-loss orders ensures that a bad trade does not wipe out your account. A common rule is to never risk more than 1–2% of your trading capital on a single trade.

Choosing a Trading Platform

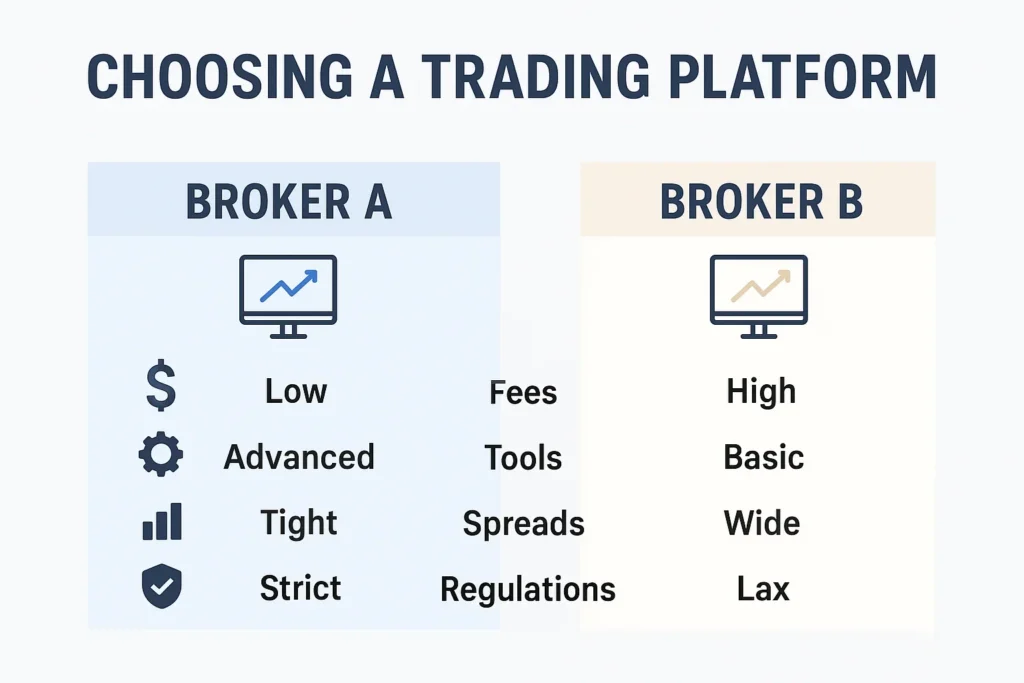

Selecting the right trading tool is crucial before you make your first trade. Check out sites that are easy to use, have good learning materials, and strong security. Demo accounts let you practice dealing with fake money, which can be helpful for people who are just starting. This makes people feel better about themselves without putting real money at risk.

Building a Learning Mindset

You won’t get rich quickly by trading forex; instead, you’ll learn to focus, be patient, and develop a strategy. Every trader who is now successful started as a beginner who made mistakes and learned from them. Keeping a trading journal can be very helpful in tracking choices, results, and lessons learned.

It is essential to keep learning. As markets change, so do the ways that traders use them. Over time, books, online courses, webinars, and having a guide can help you learn more and get better at what you already know.

Taking the First Step in Forex

Trading big is an easy and fun way for newcomers to get into the currency markets. They are safer to enter than less popular pairs because they are more liquid, have lower costs, and are more clearly affected by the economy. Anyone can start looking into the possibilities in the forex market as long as they start small, learn how to manage risk, and build a strong base of knowledge.

At first, forex dealing may seem complicated, but like any other skill, it gets easier with time and effort. If you start with the major pairs, you can start in a market that is easy to get into and has a lot of promise. Do things one step at a time, keep up with the news, and remember that regularity is the key to long-term success.