Disclaimer: This article is for informational purposes only and does not constitute financial, investment, or legal advice. Always consult a qualified professional before making financial decisions related to CBDCs, stablecoins, or digital assets.

CBDCs and stablecoins are not just buzzwords. They represent the future of money.

CBDCs are digital banknotes issued by governments. They promise stability and public oversight. Stablecoins, on the other hand, are private digital tokens designed to keep their value steady. They aim to offer fast, low-cost transactions.

This article asks: Are they allies in reshaping finance, or are rivals jockeying for global dominance?

Definitions & Key Differences

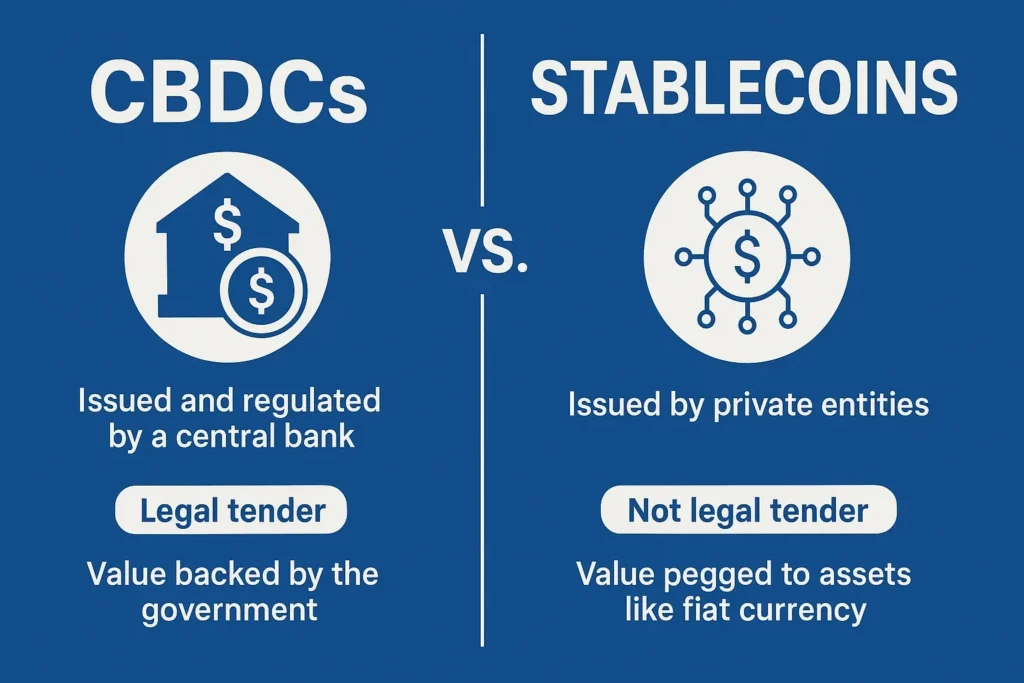

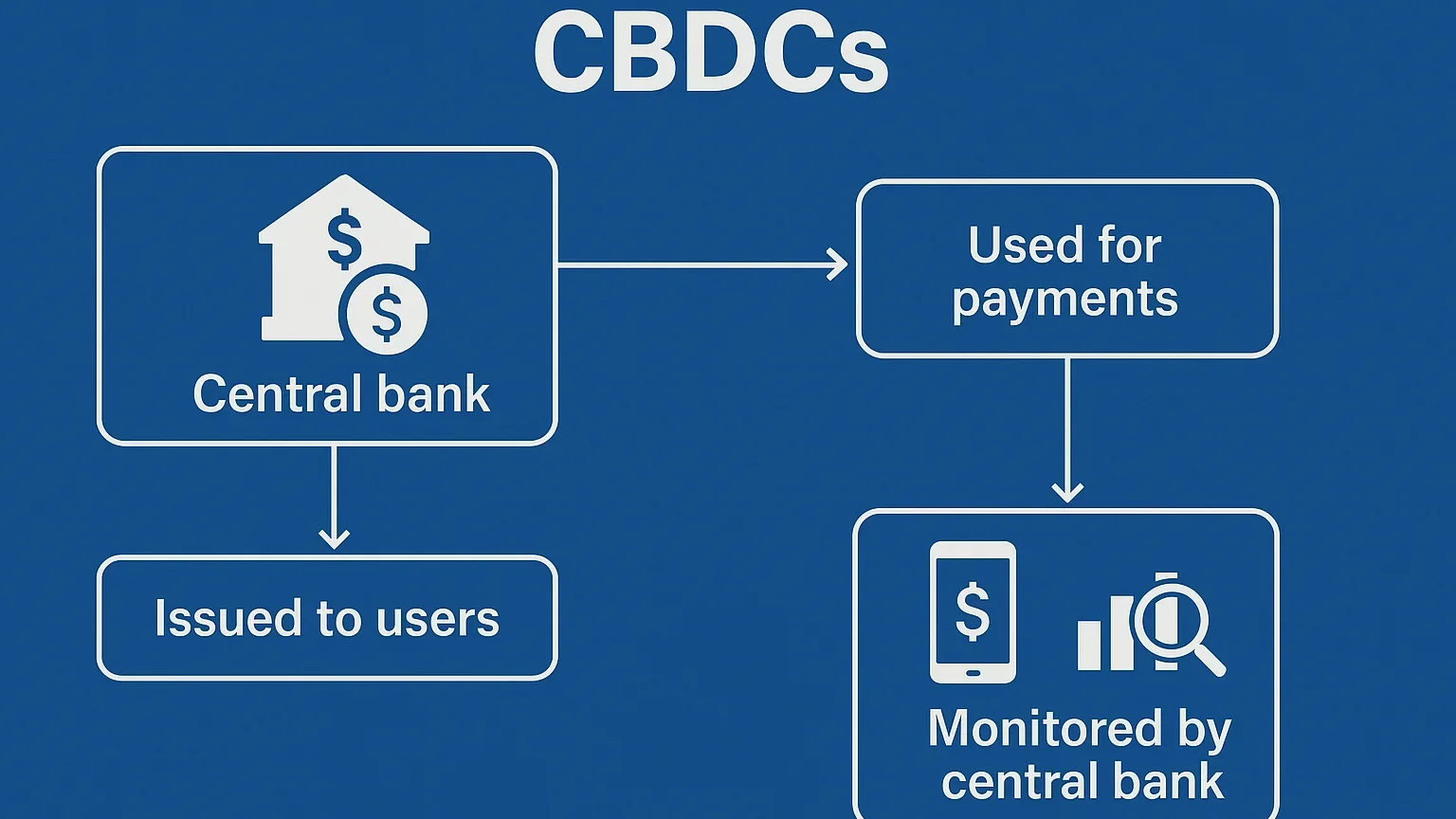

CBDCs are digital forms of government-backed money. A central bank issues them. And they function as legal tender. They carry the full faith of the state and act like cash but live on your phone or bank app.

Stablecoins are private digital tokens whose value is tied to a reserve asset, such as the US dollar, gold, or another cryptocurrency. They aim to remain stable and avoid the wild swings seen in Bitcoin.

Main difference? Issuers and backing.

- CBDCs are liabilities of a central bank. National governments guarantee them. And regulatory oversight is strong.

- Stablecoins are issued by companies or decentralized autonomous organizations (DAOs). Many promise 1:1 asset backing, but audits and transparency vary widely.

Other key contrasts:

- Control: Governments control CBDCs and can set policy or freeze assets. Stablecoin governance depends on private issuers or protocols.

- Technology: Some CBDCs utilize blockchains, but most employ centralized ledgers. Stablecoins reside on public blockchains and integrate with multiple applications.

- Trust model: CBDCs rely on government trust. Stablecoins rely on the issuer’s credibility and transparent reserve management.

Understanding these differences helps avoid confusion regarding risk, privacy, and control in the subsequent sections.

The Core Tensions: Control, Privacy & Stability

Governments gain power with CBDCs. They can freeze accounts or set spending rules. That creates deep privacy worries. Without strong legal protection, every purchase could be traced. Central banks face pressure to strike a balance between privacy and anti-money laundering rules.

Stablecoins offer more autonomy. But they bring financial risks. Failures like TerraUSD in 2022 demonstrated that stablecoins can lose their peg and lose money quickly. And regulators fear stablecoins could leak outside standard banking controls. The BIS warns they could threaten monetary rulebooks and trigger liquidity crises.

Control and Oversight

CBDCs centralize authority. That gives governments tools to combat crime and enforce policy. But it also opens the door to censorship, surveillance, and even social credit systems.

The stablecoin is private. People can use them without government tracking. But issuers can also shut down your assets or halt transfers. US law (GENIUS Act) even mandates freezing powers for courts.

Privacy Trade-Off

CBDCs can be set for complete transparency or partial anonymity. But in practice, traceability wins. And that scares people used to the privacy of cash.

“Stablecoins often run on public blockchains, meaning transactions are visible to anyone. Even so-called ‘anonymous’ tokens can be traced using advanced data analytics techniques.

System Stability

CBDCs offer stability and secure backing from central banks. They carry the weight of government reserves. And they can help prevent bank runs by providing a safe and trusted means of money.

Stablecoins rely on private reserves. They can work with tangible assets, such as U.S. Treasuries. However, not all issuers stay fully backed or transparent. BIS and scholars warn that reserve issues could spark runs and threaten the stability of financial systems.

Use Cases and Applications

Stablecoins shine in cross-border payments. They let you send money overseas in minutes. And you avoid hefty bank fees and slow processes. This approach works exceptionally well in countries with weak banking systems or unstable currencies.

CBDCs also aim to streamline global transfers. They can settle payments around the clock and reduce costs between central banks or banks. Projects like mBridge demonstrate how multiple central banks can cooperate on real-world transactions.

Every day, retail spending

Stablecoins already power e‑commerce and peer-to-peer spending. Some merchants and apps accept USDC or USDT, providing users with a fast and predictable way to buy USDT with USD, pay for goods, or transfer funds easily.

Major companies, including PayPal, Amazon, Walmart, Uber, and Bank of America, are exploring the use of stablecoins for payments and treasury functions.

CBDCs could also function like e-cash on your phone or app. India’s digital rupee pilot includes QR-code payments and offline transactions for areas without reliable internet. The ECB is designing a digital euro for fast and secure consumer payments.

Wholesale and institutional use

Stablecoins support decentralized finance (DeFi), smart contracts, and trading. They help users move funds between protocols or trade without losing value due to volatility.

CBDCs, in wholesale form, enhance settlement between banks, reduce counterparty risk, and facilitate interconnected cross-border networks.

Financial inclusion & new services

Stablecoins serve unbanked and underserved communities by enabling saving, lending, and making payments more efficiently.

CBDCs can offer direct welfare, pension, and subsidy payments, such as Nigeria’s naira, which are credited directly to citizens.

Areas of Convergence: Can They Coexist

CBDCs and stablecoins can work together effectively. They both use digital rails and can be interoperable. Central banks exploring CBDCs are considering partnerships with private issuers to expand use. This approach leverages trust and innovation simultaneously.

Stablecoins could run on CBDC platforms. This means a government-backed digital currency provides the backbone. Private developers build additional services on top of it. That hybrid model offers flexibility with official oversight.

Shared infrastructure

Some countries test shared ledger systems. This lets them exchange across platforms. Ensures fast and low-cost settlement for all users.

Regulated private issuance

Governments are creating clear rules for stablecoin issuers. They focus on transparent reserves and auditability. This enhances stability while preserving private innovation.

Wholesale collaboration

CBDC projects often include private firms in development. Such public-private partnerships also boost scalability. Major financial institutions already co-develop CBDC pilots with fintechs and token issuers.

Market Reactions & Public Perception

The stablecoin is gaining strong market interest. Circle’s USDC issuer went public in June 2025. Its stock surged over 450% from $31 to $180, then settled around $185, signaling investor optimism, though analysts caution about valuation uncertainty. Traders also saw a 167% intraday spike after its debut, fueled by hopes around the GENIUS Act, which could solidify stablecoin regulations.

And yet, there’s caution. JP Morgan recently halved its stablecoin growth forecast to $500 billion by 2028, stating that mainstream consumer use remains limited. Most activity today is in cryptocurrency trading and DeFi rather than retail payments.

Public institutions and fintech are warming to stablecoins. Companies like PayPal, Amazon, and Walmart view them as a means to reduce payment fees and streamline treasury operations. Meanwhile, regulators in the U.S. and Europe are developing frameworks to integrate stablecoins into the mainstream, striking a balance between innovation and consumer safety.

Consumers and crypto investors are diverse and watching closely. A new survey reveals that they’re politically diverse, often male, and risk-oriented, relying heavily on social media and video for crypto news. But when it comes to CBDCs, sentiment is mixed. European surveys indicate low enthusiasm and slow adoption, with only 13 million digital wallets created in Nigeria over three years.

Governments are building trust. Central bank announcements tend to improve positive sentiment among consumers, especially when clear communication about features is provided.

Conclusion: Friends, Foes, or Frenemies?

CBDCs bring government-grade stability and oversight. Stablecoins offer private-sector innovation and speed. They overlap in key use cases, such as payments, financial inclusion, and increasingly, data analytics for transaction insights and risk monitoring.

But tensions remain. Governments worry about losing control. Private issuers, meanwhile, are concerned about being sidelined by regulation. Privacy, trust, reserves, and the responsible use of data analytics are ongoing battlegrounds.

Hybrid models are gaining traction. These blend CBDC foundations with stablecoin services, leveraging data analytics to enhance transparency and system efficiency. They offer a balanced path forward.

Ultimately, neither wins outright. They each have strengths. Together, they could reshape global finance in complementary ways.