Table of Contents

Despite significant harvest volumes, the sector has suffered from a series of crises in recent years. In 2022 alone, the industry faced $1.8 billion in losses, largely due to price drops, market disruptions, and climatic changes. Furthermore, rising global competition and the closure of key fisheries are intensifying challenges. This case study explores the industry’s state in 2025, examining the factors contributing to its crisis, its economic impact, and the pathways toward sustainable recovery.

Economic Overview of the Alaska Seafood Industry

The Alaska seafood industry is a crucial component of both the state’s and the national economy. It is responsible for producing more than 60% of the U.S. seafood harvest, with over 5.8 billion pounds of seafood harvested in 2022, valued at $2.0 billion. Alaska’s seafood sector alone contributes approximately $6 billion annually to the economy, with $5.2 billion in wholesale value from processed products.

Key Economic Data:

- Harvest Volume: 5.8 billion pounds

- Ex-Vessel Value: $2.0 billion

- Processed Product: 2.3 billion pounds valued at $5.2 billion at first wholesale

- Value Added by Processing: $3.2 billion

- Contribution to State GDP: $6 billion annually

- Employment: Direct employment of 48,000 people, with an additional 33,000 jobs supported in the broader U.S. economy.

Challenges Facing the Industry: 2022-2025

In the period between 2022 and 2023, Alaska’s seafood industry faced profound losses that exacerbated its challenges.

Economic Losses:

- $1.8 billion loss in total industry output due to market forces and price fluctuations

- 50% drop in profitability across key seafood sectors

- $4.3 billion reduction in total U.S. seafood output

- $191 million in state and local tax revenue losses across Alaska and other coastal states

These figures represent a sharp contrast to the industry’s prior success. The loss of revenue is compounded by the loss of key commercial fishing jobs, with an 8% reduction in employment in the harvesting sector, dropping to fewer than 5,900 jobs per month in 2023.

Decline in Employment and Local Ownership:

- 8% reduction in harvest-related jobs in 2023, the lowest level since 2001.

- In the Bristol Bay salmon fishery, locally owned setnet permits declined by 54%, and locally owned driftnet permits dropped by 59% between 1975 and 2023.

This reduction is partly due to structural changes within the industry, including market-driven consolidations and the increasing presence of large corporate players, leaving smaller, local operations at a disadvantage.

Global Competition and Rising Imports

A critical factor affecting Alaska’s seafood industry is the increasing competition from international markets. Russia, in particular, has become a significant player in the global seafood industry. In 2025, Russia’s pollock quota increased by 7% to 2.46 million metric tons, further lowering the market value of Alaska’s pollock, which competes with Russian pollock on the global market.

This increase in Russian catch, alongside expanding fish farms in regions like Chile and Norway, has pushed prices down and reduced the value of Alaska’s wild-caught fish. Additionally, the rise of aquaculture and the farming of fish have introduced low-cost alternatives to wild-caught fish, further threatening Alaska’s seafood position in the market.

- There is an increase in seafood imports of 42% from January to February 2025.

- Farmed salmon from regions like Florida, Norway, and Chile are encroaching on Alaska’s market share, particularly in the wild salmon sector.

|

Metric |

2023 Actual |

2024 Forecast / Projection |

2025 Outlook |

|

Total Seafood Harvest (MT) |

2.4 million |

Slight increase in groundfish TAC (2.5 million MT) |

Expected recovery in prices and demand |

|

Salmon Harvest (million fish) |

~230 million (large pink salmon year) |

~135 million (smaller pink salmon year) |

Variable; Bristol Bay sockeye mix forecasted |

|

Bristol Bay Sockeye Run (million fish) |

54.5 million |

39 million (forecast) |

Composition forecast: 39% two-ocean, 61% three-ocean |

|

Export Volume (MT) |

878,000 |

Data pending; expected stable or slight growth |

Recovery expected in export prices |

|

Export Value (USD) |

$2.8 billion |

Expected to remain challenged due to market conditions |

Price recovery anticipated |

|

Largest Export Markets |

Japan (value), China (volume) |

Same major markets |

Continued importance of Japan, China, and others |

Environmental and Climatic Pressures

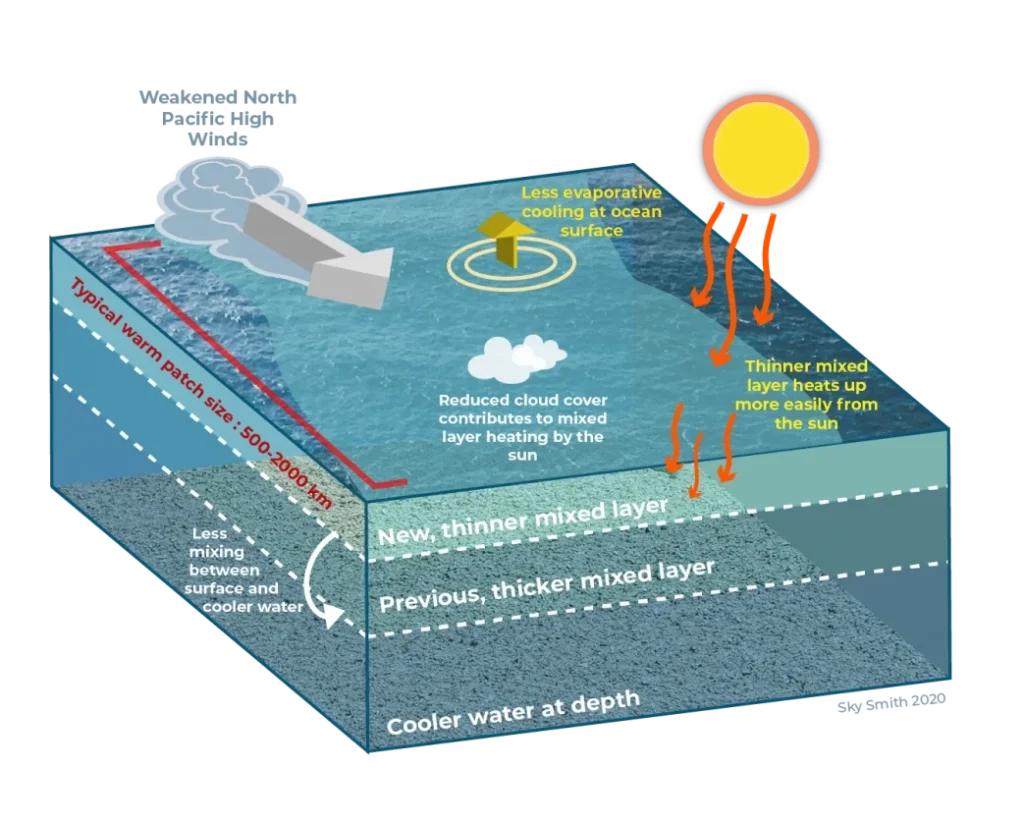

Climate change is increasingly recognized as a key factor contributing to the declining health of Alaska’s fisheries. In particular, warmer ocean temperatures, driven by climate change, have led to stock crashes in key fisheries like the Bering Sea crab fishery, forcing the cancellation of several lucrative harvests.

- Marine heatwaves linked to climate change have severely impacted the viability of certain fisheries, particularly for crab and some fish species.

- The melting of sea ice and changing ocean temperatures disrupt fish habitats, altering migration patterns and reducing fish stocks.

Economic Impact on Communities

The decline in Alaska’s seafood industry has had a direct and profound impact on coastal communities.

-

Local Economies:

-

Municipal Revenue Losses:

Small, fishing-dependent towns like Kodiak and Dillingham are suffering from the ripple effects of the sector’s downturn, with decreased local employment, tax revenue, and economic activity.

In some of Alaska’s coastal municipalities, the seafood industry constitutes the largest tax revenue source, and its decline has led to fiscal shortfalls. Local governments have faced up to $191 million in lost revenue, which affects everything from public services to infrastructure development.

Government and Industry Response

Recognizing the importance of the seafood industry, both state officials and industry leaders have called for urgent action. In 2024, a legislative task force was formed to address the crisis and propose solutions to stabilize the industry. Some key proposals and efforts include:

- Increased funding for fisheries and environmental research to better understand the impacts of climate change on fish populations.

- Enhanced federal trade policies to combat unfair competition, particularly from Russia’s increasing pollock quotas.

- Modernization of infrastructure to update processing plants and cold storage facilities that have aged since the 1970s and 1980s.

- Incentives for local ownership of fishing permits and support for smaller fishers to ensure that local communities can maintain their economic viability.

Where Alaska’s Seafood Goes: Top Countries Importing Alaskan Exports

Alaska sells seafood primarily to the following countries and regions:

- The United States: The largest single market for Alaska seafood, accounting for over half of Alaska’s seafood export value.

- China: Historically the largest importer by volume, though exports to China have declined in recent years due to tariffs and trade challenges. China remains important as a reprocessing hub where some Alaska seafood is processed and then re-exported.

- Japan: The largest importer by export value, a key market for high-value Alaska seafood products.

- Europe: Including countries in Northern and Central Europe, with growing exports over the years.

- South Korea: A significant importer of Alaska seafood.

- Canada: Both a direct importer and a transit point for Alaska seafood to the U.S. mainland.

- Southeast Asia: Emerging and growing markets including Vietnam, Malaysia, Thailand, Indonesia, the Philippines, and Singapore. Alaska seafood exports to this region have doubled since 2013, with targeted marketing efforts ongoing.

- Latin America: Markets such as Peru and Brazil are being developed as alternative destinations, especially following challenges in the Chinese market.

Future Prospects and Solutions

The Alaska seafood industry stands at a crossroads. To ensure a sustainable future, a multi-pronged approach is needed. Potential solutions include:

-

Diversification of Markets:

-

Climate Adaptation Strategies:

- Infrastructure Modernization:

- Trade Policy Reform:

Expanding into new domestic and international markets for Alaska’s premium wild-caught seafood, with a particular focus on sustainability certifications that can help differentiate Alaska products.

Implementing adaptive fisheries management strategies to account for climate change, such as the development of new fishing zones and investment in sustainable aquaculture methods.

Upgrading aging infrastructure, including processing plants, transportation networks, and cold storage facilities, to make the industry more competitive and resilient.

Pushing for stronger U.S. trade policies to address the unfair practices of countries like Russia that undermine Alaska’s competitiveness.

Final Words

The Alaska fishing and seafood industry is a vital contributor to the state’s economy, but it is under significant pressure from both domestic and international factors. The combined effects of climatic changes, market competition, and structural shifts have placed the industry in a precarious position. However, with targeted action, strategic investment, and collaborative efforts from government and industry stakeholders, Alaska’s seafood sector has the potential to recover and thrive, continuing to be a cornerstone of the state’s economy for generations to come.

FAQS

Silver Bay Seafoods is one of the largest seafood companies in Alaska, operating thirteen processing facilities throughout the state and the West Coast.

Alaska’s fisheries are facing a crisis due to collapsing fish prices, processor bankruptcies, declining salmon runs, rising costs, weak demand, global competition, and ecological shifts from climate change, including warming waters and stock collapses.

Alaska’s seafood industry contributes over $6 billion annually to the state’s economy.

Ketchikan is known as the “salmon capital of the world” in Alaska.

Salmon is the most common and iconic fish in Alaska, with five main species: king, sockeye, coho, pink, and chum salmon.